Share on

- Copy link

The Crypto market has been in a bearish cycle for almost a year now with few pullbacks. After struggling for some months, the flagship currency, Bitcoin, is finally recovering as the asset has crossed $20k, its psychological price mark.

Last updated Nov 7, 2022 at 01:32 PM

Posted Nov 7, 2022 at 01:30 PM

The main cryptocurrency Bitcoin (BTC), which had been fluctuating in a small spectrum since early September due to a protracted period of exceptionally low volatility, surged beyond the $20,000 mark during last week's trading session. When the price of the flagship currency reached $20,961, questions regarding whether the bottom had been achieved reappeared.

We will analyze what can be the possible reasons behind the recovery of the crypto market. We will also look at whether this recovery of Bitcoin and altcoins is the end of the bearish cycle.

Performance of the Crypto market in 2022

Since its high in late 2021, the value of bitcoin (BTC) and ethereum (ETH) has decreased by more than 50%. Apart from some minor advances in recent days, the crypto market is still mostly in a relatively stable condition. Numerous observers think that the value of cryptocurrencies may decrease even more before experiencing a long-lasting rebound; however, nobody can be confident of this.

The crypto market cap climbed to a peak of about $3 trillion in November 2021. As a result of rising inflation and a bleak macroeconomic environment, it had declined more than two-thirds of its value by November 2022. Doubts regarding the purpose and function of digital currencies in the larger economy eventually arose, pitting fervent proponents against skeptics.

Crypto liquidations wiped out billions of dollars. Critics once again got a chance to point out the issues of the crypto market. Some experts from the industry claim that the crypto crashing market will continue to decline, but history points out that crypto has always made a comeback. Let’s see.

Current Situation of the Crypto Market

At the time of writing, the total crypto market cap is above $961 billion according to the tradingview. On October 13, the market cap of the crypto market plunged to $838 billion. Since then, the market has been recovering and now stands at these levels.

Crypto market cap

This recovery of the market has helped Bitcoin cross its psychological resistance level of $20k. The crypto crashing market seems to be stabilizing after months of turbulence. Bitcoin has been a major player in these price movements of the market.

We might see a different mode of the cryptocurrency market in 2023. Let’s see how Bitcoin has performed this year:

After a fantastic performance last year, the bitcoin value topped $68,000 in November, setting a new record high. But everything collapsed this year.

Amid continued policy uncertainty brought on by inflationary pressure, a weak financial sector, interest rate hikes, and worries about a downturn, Bitcoin and the larger cryptocurrency market have been declining this year.

Price Performance of Bitcoin.

Source: TradingView

Since last November, Bitcoin has lost more than two-thirds of its price and recently fell as low as $17,500. On whether bitcoin has reached its bottom yet, experts have different opinions. Some predict Bitcoin Bottom has been reached, while others expect a drop to $10,000 for bitcoin in 2022.

Although the Bitcoin price today is more than $20k, the next turn of the asset is yet to be seen. The Bitcoin price prediction of a $10k price level seems far-fetched, but if the situation remains bearish, we might end up there.

According to CoinMarketCap, Bitcoin is holding its price above $20k. Bitcoin price today remains almost identical to yesterday with little change.

Bitcoin volatility has been touching new lows in the last few months. In this fight of bulls and bears, bears have been winning for most of the time, but the current recovery of the asset shows that bulls are ready to take control. The graph below shows the struggle of bitcoin to cross and maintain a price level above $20k.

Bitcoin has been struggling for over a month to cross $20k

According to CoinMarketCap, the market cap of Bitcoin is $388 billion at the time of writing. The asset’s market cap has improved a lot over the last month. The graph below shows how the market cap of the asset improved in October:

Crypto Market Cap recovery in October 2022

The 24-hour trading volume also remains unchanged, although the flagship currency is 70% down from its all-time high from a year ago.

The Crypto market is recovering; many asset gains exceeded 10% in the last week. The previous week, Bitcoin did see a positive comeback of over 10%, and bitcoin volatility significantly decreased, particularly over the last three days. Let’s see the factors which might have triggered this recovery:

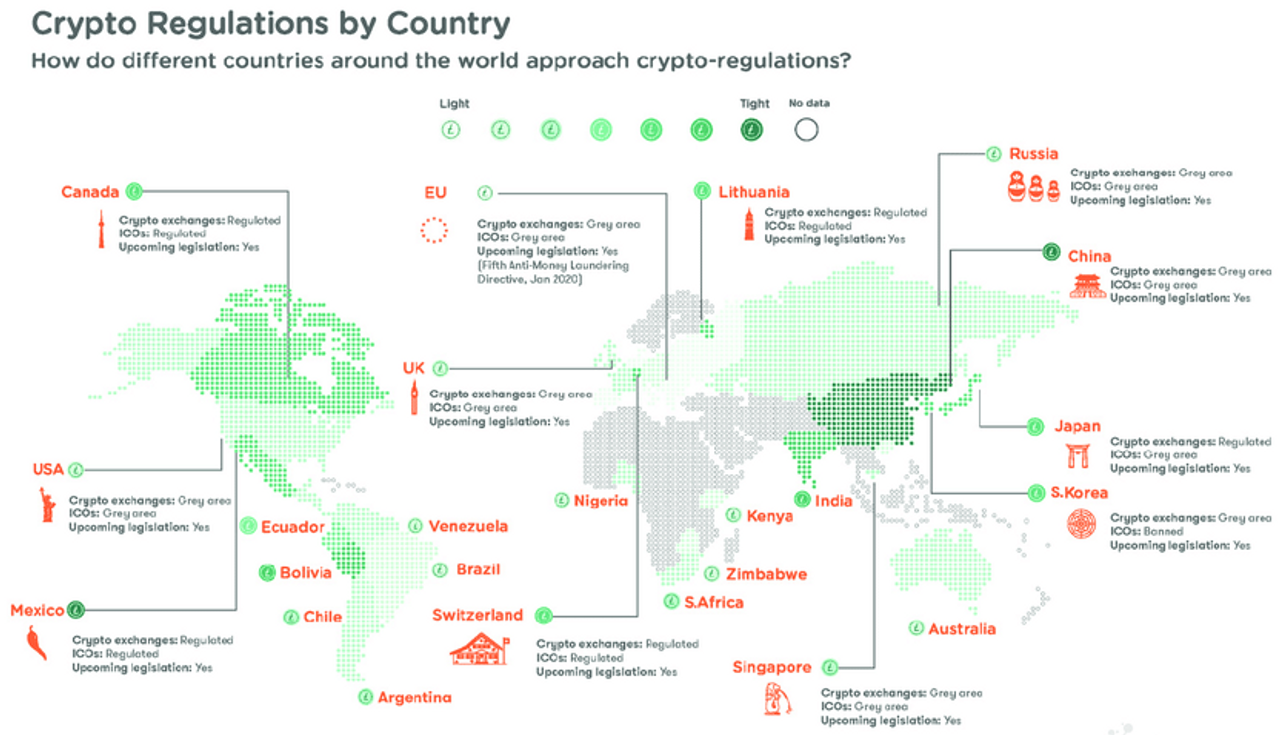

Expect more discussions on crypto regulation as policy makers in the US and throughout the world attempt to develop guidelines and regulations that will make bitcoin better for users and less desirable to hackers.

The countries are discussing how they can incorporate crypto assets into the mainstream. The United Kingdom’s newly elected prime minister, Rishi Sunak, is a crypto enthusiast. His vision includes making the UK a Crypto-hub.

Crypto regulations in several countries

The U.S. government has expressed a strong desire to participate in virtual currency regulation due to the most recent Terra Luna crash. Due to the collapse of the cryptocurrencies in May, stablecoins TerraUSD (UST) and Luna, which are linked, both saw price declines.

In 2022 there were important regulatory developments. A presidential executive order that President Joe Biden signed in March tasked federal agencies with looking into the "sustainable evolution" of virtual currencies, such as stablecoins.

The U.S. Treasury Department has officially announced the first directive coming from President Biden's executive order on cryptocurrency assets. It outlines how the United States should deal with other countries regarding cryptocurrencies.

This improving crypto regulation is one of several factors of the crypto market recovery. Bitcoin and altcoins will hopefully continue their bullish stance.

Blockchain technology and cryptocurrencies attracted conventional firms from a variety of industries in 2021, and in some situations, they ultimately established their own stakes. For instance, AMC announced last year that it will accept payments in Bitcoin.

Institutional Investors in the Crypto space

By enabling customers to purchase on their platforms, fintech businesses like PayPal and Square are also placing a bet on cryptocurrencies. Tesla has billions of dollars worth of cryptocurrency assets and accepts Dogecoin payments, but it is still undecided about accepting bitcoin payments. Experts anticipate an increase in this buy-in.

Although few shoppers currently see the benefit of paying with cryptocurrencies, as more merchants begin to accept them, the situation can change.

The entry of Google into the crypto ecosystem might be a trigger of this current bullish stance. Google has partnered with Coinbase to accept cloud service payments in the crypto assets.

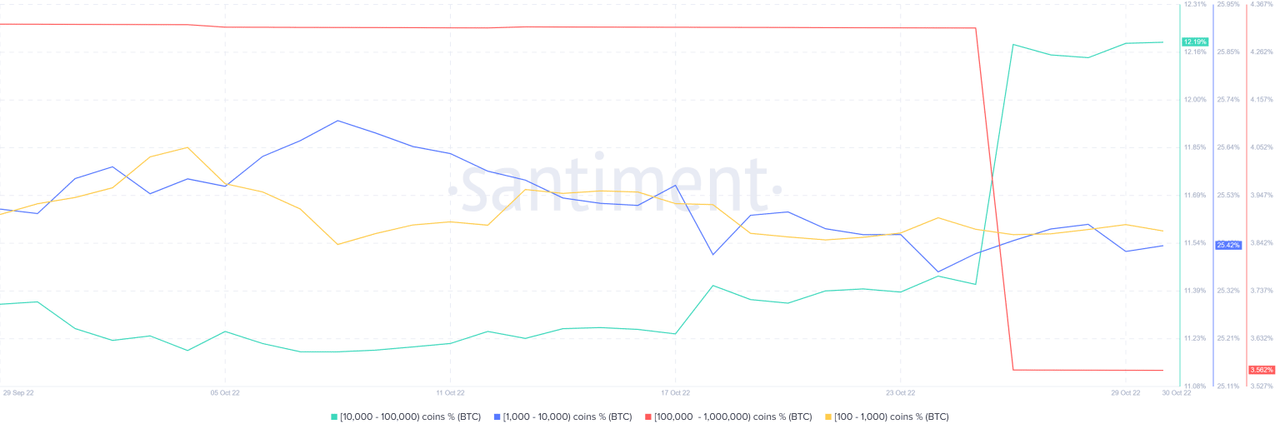

The latest increase was spurred by institutional buying demand, according to CryptoQuant research by TariqDabil (Pseudonym). In other words, the analysts claimed that large shareholders and whales made up a very small portion of the market.

This interpretation may be accurate because the most recent upswing lacked the regular long candles that would suggest powerful major buying. This didn't necessarily imply that there was no whale activity. In fact, throughout the month, there was some positive pressure coming from accounts possessing between 10,000 and 100,000 BTC. An increase in buying pressure from account numbers in the range of 100 to 100,000 was observed in last week's performance.

Whale Activity

Source: Santiment

Additionally, during the week, there were net outflows from addresses with between 100 and 1,000 coins, suggesting that whales were pocketing more money as the price rose. On October 25, addresses containing between 100,000 and 1 million experienced a sudden exodus. Exchange addresses are probably represented by this whale category.

The Crypto market is recovering, but this recovery might not continue for long. Without demand from whales, Bitcoin will find it difficult to maintain its short-term uptrend. After that, there will probably be an upsurge in pressure to sell, leading to another gloomy result. Bitcoin volatility will play a huge role in the recovery of the whole market.