Share on

- Copy link

Bitcoin vs Gold is an ongoing debate, and investors are trying to figure out which one is a better investment option for the next 10 years.

Last updated Mar 5, 2023 at 08:36 PM

Posted Mar 7, 2023 at 02:00 PM

Investing is effective in putting your money to work and building wealth for the future. Gold was formerly a popular investment option, but since the creation of cryptocurrencies, investors have a far wider range of options for long-term investing. Gold and Bitcoin are the two most appealing choices; both assets have their benefits and risks. In an old-school capital preservation investment method, gold might seem a preferable option as it saves you from unwanted losses during a downward economic trend. An investment in gold carries fewer risks, but there are also fewer chances of high returns. However, the exponential growth and growing popularity of cryptocurrencies especially Bitcoin are challenging this old-school investment method.

Which asset is more reliable as an investment option for the next 10 years?

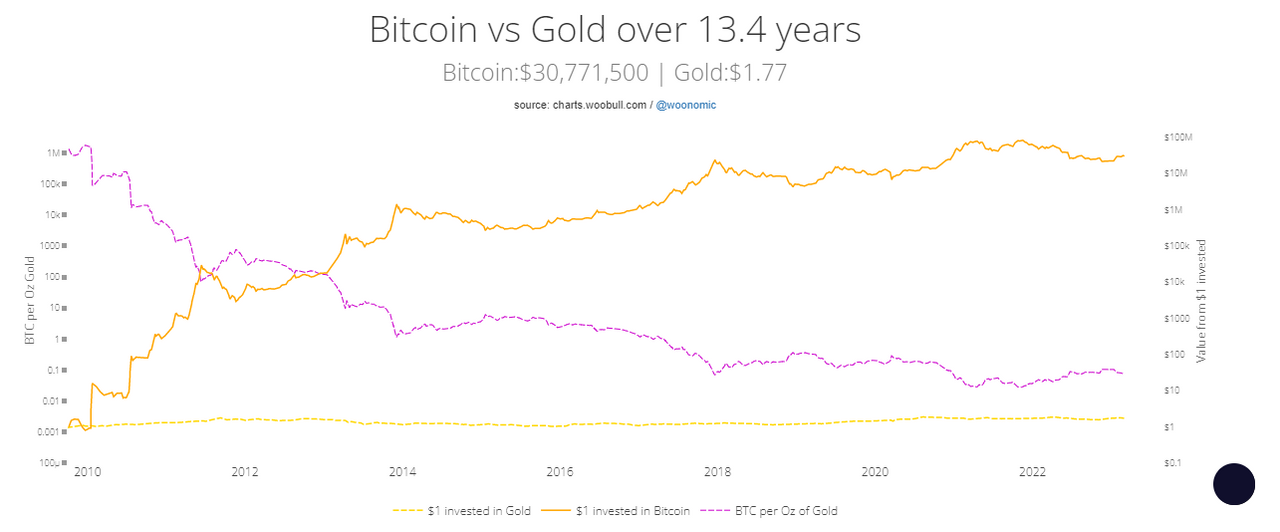

Bitcoin, often called digital gold, has shown exceptional growth since its creation in 2009. According to data on Investing.com, the price of Bitcoin in 2010 never went above 0.40. The same year, a random crypto holder bought two pizzas for 10,000 Bitcoins and it was the first time someone bought something using the cryptocurrency. Later in 2011, its price touched $1. In 2019, when Covid-19 disrupted the whole world economy and stock prices were on a downward trend, investors noticed that the Bitcoin price was not going down in tandem. They started putting money into Bitcoin and propelled its price to over $67000. As of March 2023, the total market capitalization of Bitcoin has reached $458.63B and is trading above $23434. Bitcoin is highly attractive to investors due to its accessibility, transaction speed, decentralized nature, and security. In its early days, only a few people were interested in buying and trading Bitcoin; most people were unaware of its growth potential and future worth. Right now, there are over 100 million crypto users all over the world and the numbers are increasing every day. According to this graph, your total return on investment would have been $30,771,500 for Bitcoin and 1.77 for gold if you had invested $1 in both 13 years ago.

BTC Price Gold Price Today value of $1 invested

Buy 1 yr ago $44350 $1922 Bitcoin: $0.53 | Gold: $0.96 Buy 2 yrs ago $49770 $1734 Bitcoin: $0.48 | Gold: $1.06 Buy 3 yrs ago $8563 $1610 Bitcoin: $2.76 | Gold: $1.14 Buy 4 yrs ago $3862 $1312 Bitcoin: $6.12 | Gold: $1.40 Buy 5 yrs ago $10950 $1308 Bitcoin: $2.16 | Gold: $1.41 Buy 6 yrs ago $1229 $1240 Bitcoin: $19.25 | Gold: $1.48 Buy 7 yrs ago $433.2 $1237 Bitcoin: $54.60 | Gold: $1.49 Buy 8 yrs ago $258.7 $1214 Bitcoin: $91.42 | Gold: $1.52 Buy 9 yrs ago $566.8 $1327 Bitcoin: $41.73 | Gold: $1.39 Buy 10 yrs ago $34.55 $1582 Bitcoin: $684.56 | Gold: $1.16 Buy 11 yrs ago $4.921 $1714 Bitcoin: $4,806.17 | Gold: $1.07 Buy 12 yrs ago $0.9202 $1421 Bitcoin: $25,703.36 | Gold: $1.30 Buy 13 yrs ago $0.006812 $1114 Bitcoin: $3,471,993.85 | Gold: $1.65

As investment in Bitcoin promises high returns over a short period of time, it also carries some risks such as not enough regulations, volatility, and highly fluctuating prices.

Gold has been used as currency for thousands of years. It performs strongly during economic hardship times, so it was considered a good investment option until the advent of cryptocurrencies. Gold has a tangible intrinsic value and performs well during market correction times, the total market capitalization of gold has reached around $12.126 T.

During the Covid-19 pandemic, many investors turned to cryptocurrencies and invested in Bitcoin; others followed traditional investment methods and bought gold to hold, pushing its price up from $1300 in 2019 to $2100 in 2021.

Gold prices are not highly subject to volatility and promise a fixed and safe return; however, there are also some risks associated with an investment in gold like storing problems and securing, and the profit solely depends on the capital appreciations.

Here are some key differences between the two valuable assets to help you decide which one you might want to include in your portfolio.

Gold is highly regulated and there are proper protocols you have to follow when you want to buy or sell it. You can only buy gold from registered dealers who keep a record of every customer. You cannot cross national borders when you are carrying gold until you have permission for it. It is also very hard to make fake copies of gold. Bitcoin, on the other hand, is highly under-regulated and even banned in some countries. Only two countries – , El Salvador and the Central African Republic (CAR) – have accepted Bitcoin as a legal currency. National authorities of different countries are still trying to formulate a regulatory structure for cryptocurrencies. Due to its decentralized and intangible nature, it is accessible across borders.

Both gold and Bitcoin are finite and scarce as the mined gold stocks have been increasing by 1.7% for the last 20 years and the number of Bitcoins is also increasing by 3% each year. There may still be 50,000 metric tons of gold underground, so when the price rises, miners will gladly intensify the mining, increasing supply and ultimately causing gold prices to fall.

Bitcoin, on the other hand, has a fixed supply: only 21 million will ever be produced and its supply is also kept in check through Bitcoin halving.

Gold has been around for thousands of years and it is still considered as precious as before. It is an integral part of jewelry, used in dentistry and medicine, electronics, Olympic medals, art, and many more things. Bitcoin has been around for only 14 years and it has already become one of the most valuable assets in the world with a total market capitalization of over $458 billion. Many people believe it is just a digital currency and has no practical use other than that. However, many pieces of evidence suggest otherwise. For example, Elon Musk announced that his firm has started to accept Bitcoin as a payment method. However, later the idea was terminated due to its environmental concerns.

Moreover, Bitcoin includes a variety of metaverse applications, and several Play-to-earn games also give players Bitcoin rewards.

Bitcoin and Gold both have high liquidity which cannot be compared in the same context. Gold has mainstream acceptance worldwide which makes it more liquid compared to Bitcoin. On the other hand, Bitcoin is more liquid for some people, sometimes even more than fiat currency.

Let’s put it this way: with the changing trend in technology worldwide, blockchain is becoming mainstream – paving the way for Bitcoin to become more liquid. Payments with cards are increasing and you can do a simple scan with Bitcoin which is not as liquid in the case of gold. However, from the investment perspective, it is important to note that gold has been a trusted store of value for centuries and has a proven track record of maintaining its value over time.

The debate of bitcoin vs gold for investment for the next 10 years will go on and depend on various factors. You need to define your investment goals, risk tolerance, and market conditions to come to a final decision.