Share on

- Copy link

Coinbase Transaction History is required to view your deposits and withdrawal records. You can download it to pay crypto tax and analyze your performance.

Last updated Dec 9, 2023 at 08:23 PM

Posted Dec 9, 2023 at 07:00 PM

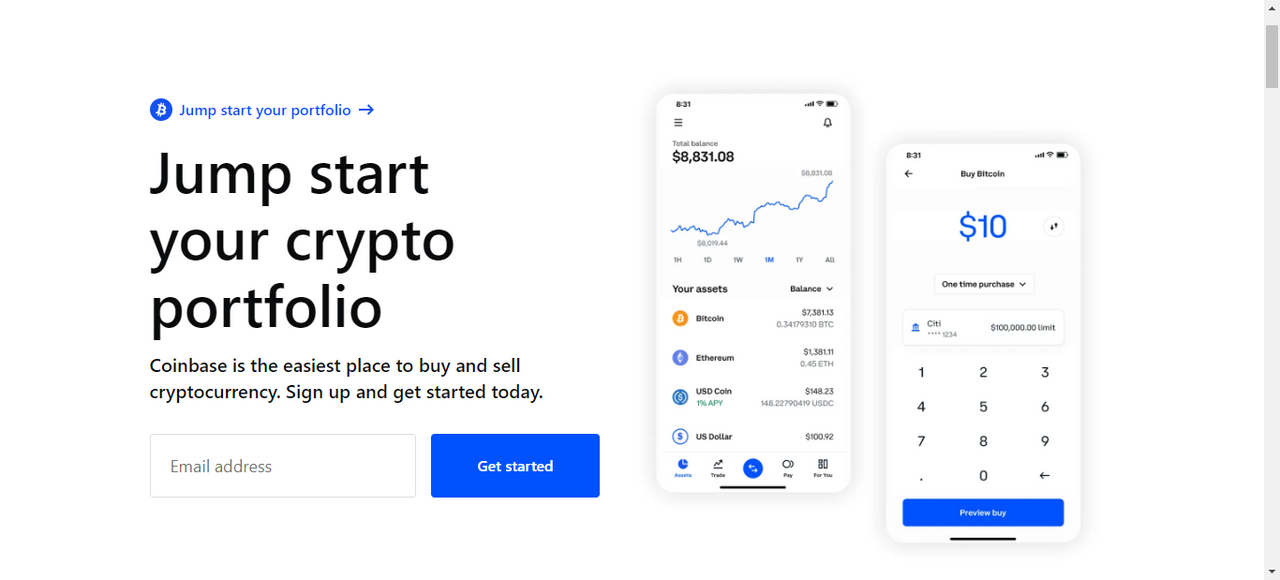

Cryptocurrency is an attractive market with amazing gains and losses due to its insane volatility. With Bitcoin price going above $40,000 and growing, it could be the start of a bull market. Many altcoins will record huge gains in this all-season, becoming a reason to bring many new crypto traders and investors and fresh cash inflows.

These fresh and professional traders either choose a centralized crypto exchange or a decentralized exchange where they can use all the features with just a web3 wallet. With so many options available to trade in 2024, it is hard to choose a perfect platform. Some traders choose Binance for its diverse crypto pairs. Those who want a well-regulated crypto trading platform might choose Coinbase for its user-friendly environment and mature features.

Crypto is being regulated worldwide and some countries have even imposed taxes on the traders. Therefore, they need to submit their transaction history while filing taxes. If you are trading on Coinbase and want to view and download your transaction history, read this comprehensive where we’ll walk you through every step.

Coinbase is the second largest crypto exchange by trading volume. It has a trading volume of an average of $2.5 billion daily. The US-based crypto exchange offers more than 700 trading pairs with multiple payment options to buy crypto. Since Binance keeps facing legal troubles, many traders, particularly those based in the US, choose Coinbase. It offers an extremely simple user-friendly interface for beginners and advanced trading tools for professional crypto traders.

Coinbase charges a tier-based trading fee from the traders ranging from 0 to 0.6% based on the amount traded. Besides crypto, traders can deposit and withdraw fiat currency in the Coinbase wallet. ACH can be deposited and withdrawn for free.

Wire transfer deposit requires a $10 fee and a $25 fee on withdrawals. SEPA deposits and withdrawals in Euro cost €0.15 and Swift deposits in GPB are free however there is a withdrawal fee of £1. Coinbase is loved by the traders for the following features:

Coinbase is an intuitive and simple trading tool. This makes it an attractive option for traders and hence it has become one of the growing crypto exchanges. Coinbase has two versions Coinbase Exchange which is for new traders and those seeking a simple trading solution and Coinbase Pro which offers complex and advanced trading tools for professional trade geeks. Here is a quick guide to download Coinbase transaction history and view your deposit and withdrawal records.

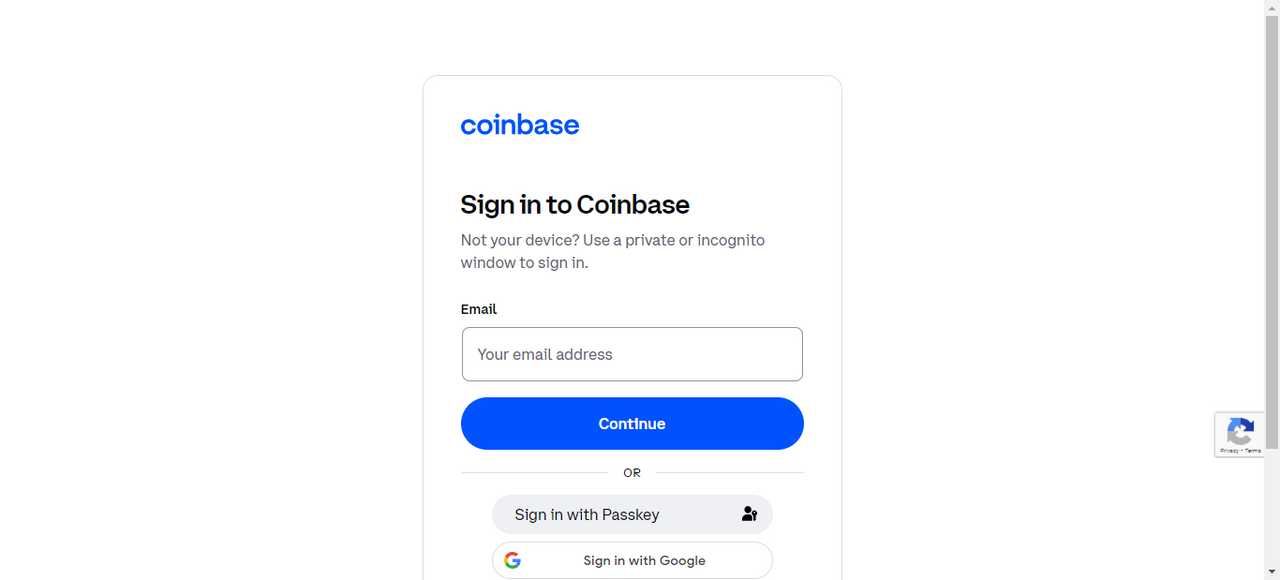

Whether you are on your phone accessing Coinbase (Mobile App) or accessing your PC (using Coinbase Web), the process is very smooth. Open your app or go to Coinbase Web and click sign in with your credentials. Once you have logged into your Coinbase account, you land on the home page of the crypto exchange.

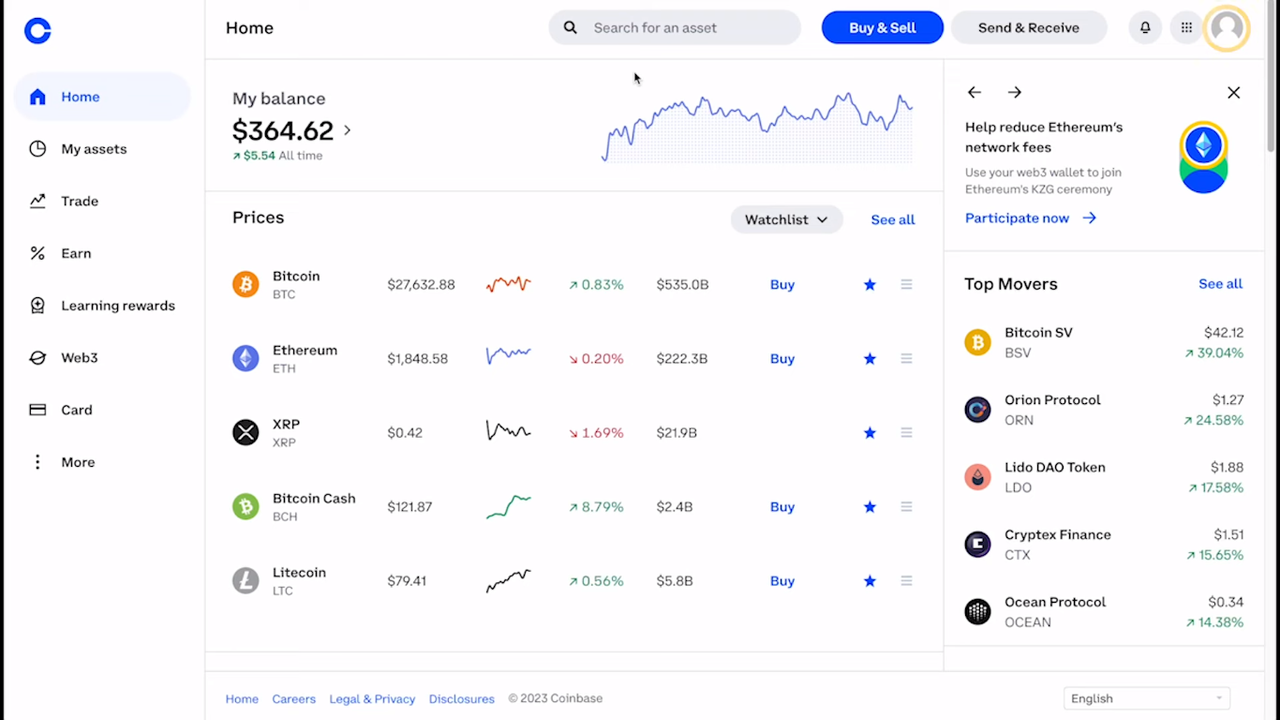

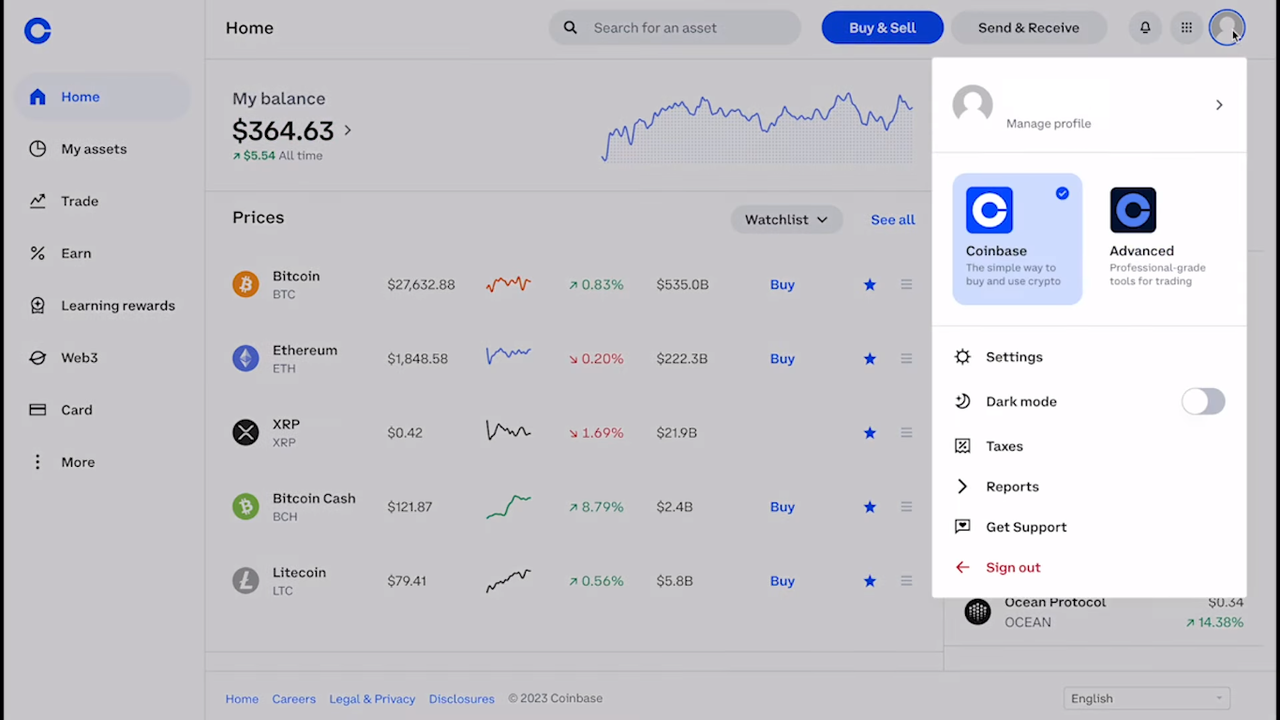

Now to generate Coinbase Transaction history reports, click on the profile icon from the top right corner of the page. It will open a drop-down the menu on click.

Now from the drop-down menu, choose the Coinbase version you want to view the history and then click on the Report button. In this example, we’ll try to generate the report for the Coinbase account.

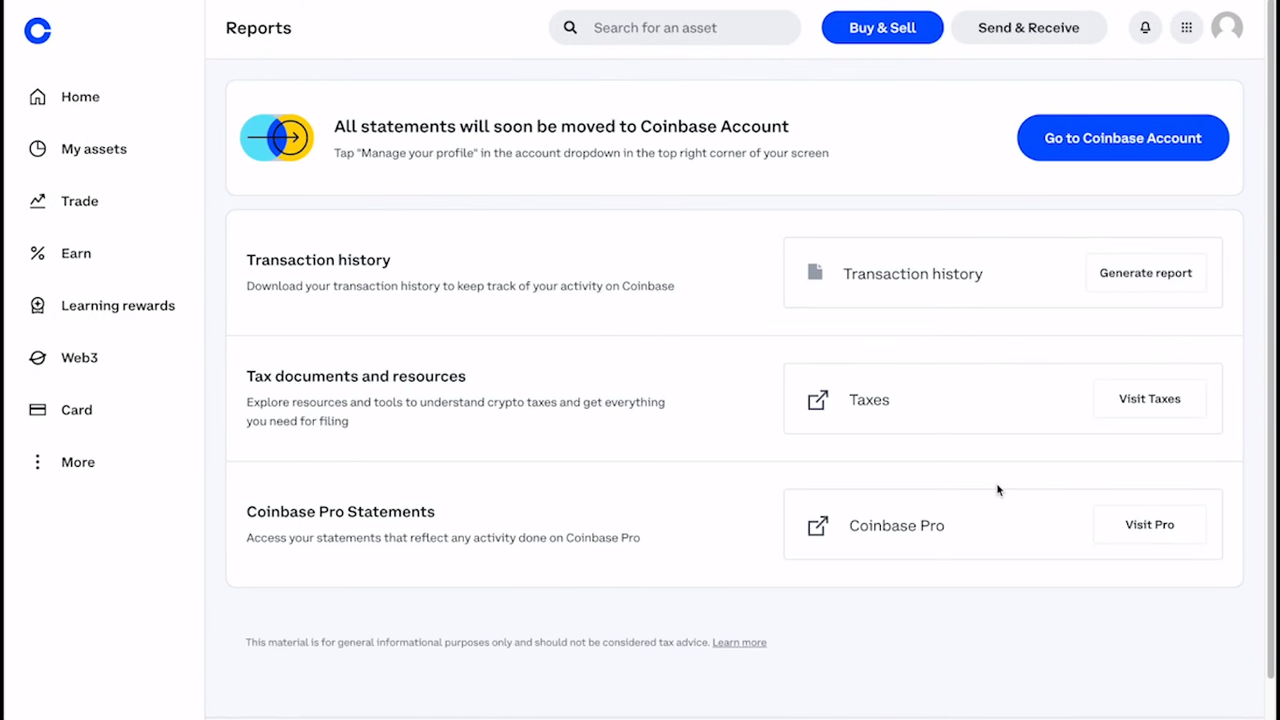

You will land on a Coinbase reports page where you can find different options to help you. You can view and download your transaction history, tax documents and resources, and Coinbase Pro statements in Excel and PDF formats.

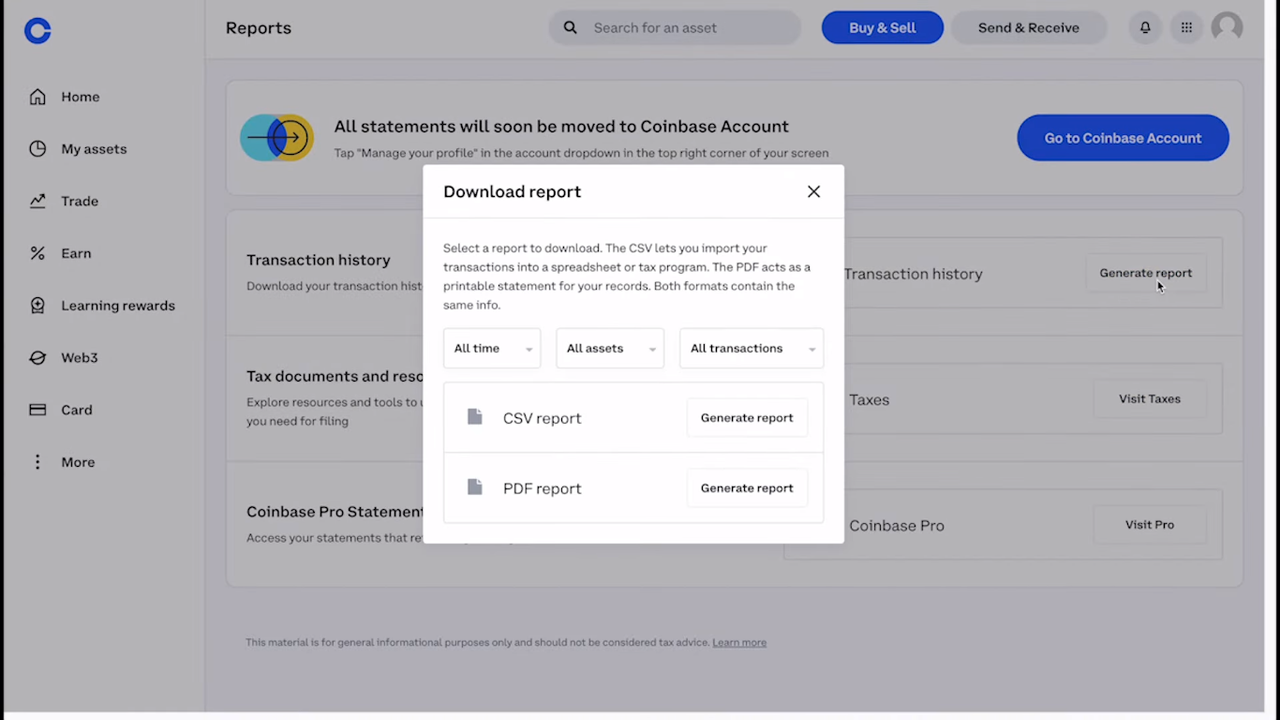

Click the Generate Report button. You’ll see a popup as shown in the screenshot below with different options to choose from. You can use different filters to download or view transaction history in different timeframes. After applying the filters, choose your desired file format (CSV or PDF) and Click on the Generate Report Button.

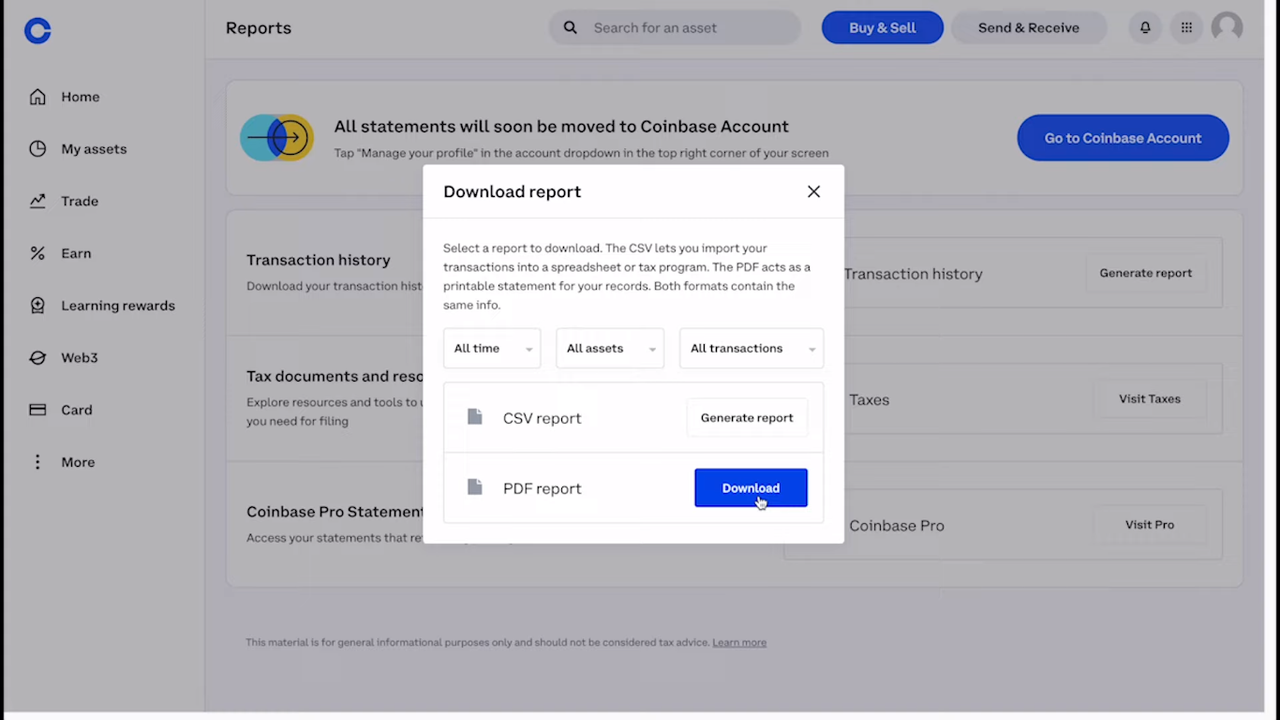

Wait a few seconds until the Download button appears and then click Download to download the report. In some cases, it might take longer if the report generated has a longer timeframe or there are too many transactions.

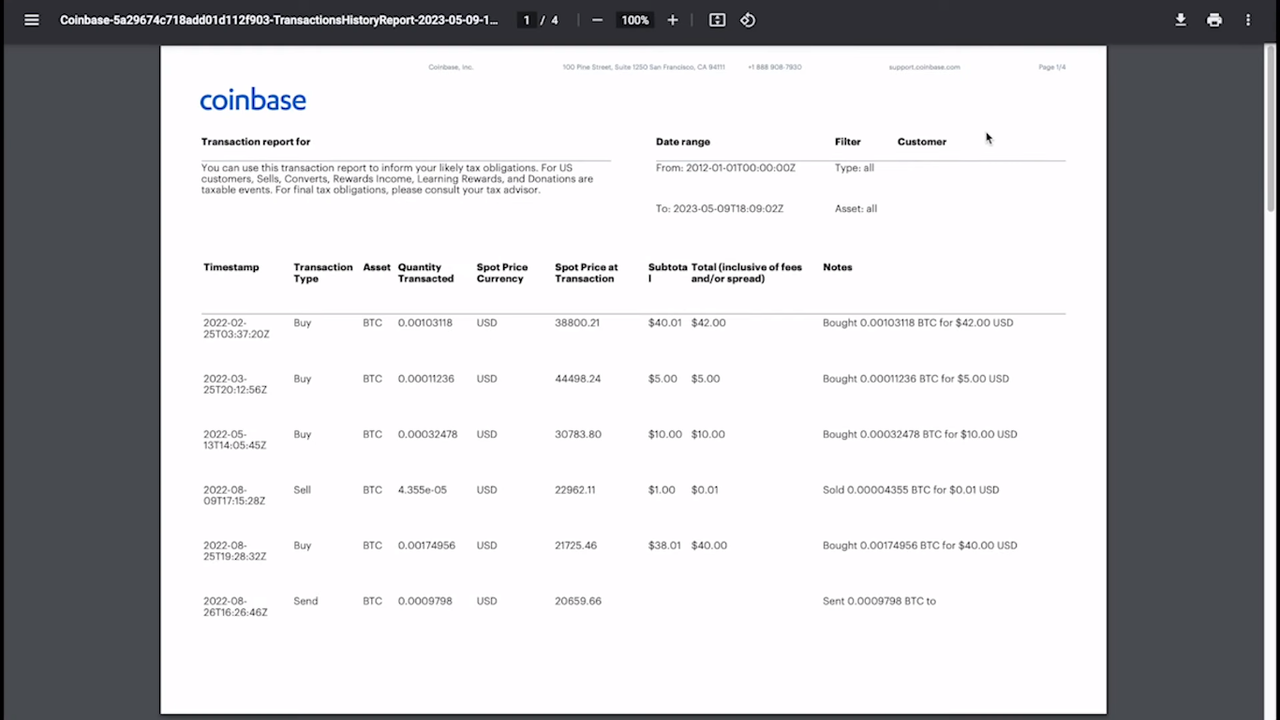

Below is a sample of Coinbase Transaction history. The report includes the transaction time and date, Transaction type, Asset type, Asset Quantity, pair, asset price, amount transacted, and the price at which the asset was traded.

Now that the report is generated and downloaded, you can use it to file taxes or keep track of your performance as a trader.

As we have seen, generating transaction history on Coinbase is extremely easy. Just sign in to your account and click your profile. From the menu choose reports and then choose the transaction history. Click on the generate button and click download.

Koinly is a master tool when it comes to filing your crypto tax without involving the complex procedures of generating Coinbase Transaction history and then manually submitting it. The tax is calculated based on your transaction history, your location, and the assets you own in your wallet. Basically, you are taxed in two different ways:

To file your crypto tax, visit the Koinly website and sign up using your Coinbase wallet. Koinly will collect all the transaction history and information about the assets you own. Alternatively, you can import a CSV file that you downloaded from Coinbase Report to Koinly and file your tax. Just like a Pro tax consultant, Koinly will submit your tax and return all the necessary information and documents to you.

Coinbase is a user-friendly crypto exchange with tons of features and regulatory compliances. However, if you want to trade new tokens you might have to choose a decentralized exchange or switch to Binance for this.