Share on

- Copy link

Macroeconomics factors are affecting the crypto market. ETH has been consolidating in a $1250-1$400 price range for the last seven days. What can you expect next in the ETH ecosystem?

Last updated Oct 4, 2022 at 01:29 PM

Posted Oct 4, 2022 at 01:25 PM

We will discuss how the macroeconomics are affecting the Ethereum price. For more than a week, ETH has been consolidating in a price range. Let’s see what you can expect next from the asset.

What’s Happening?

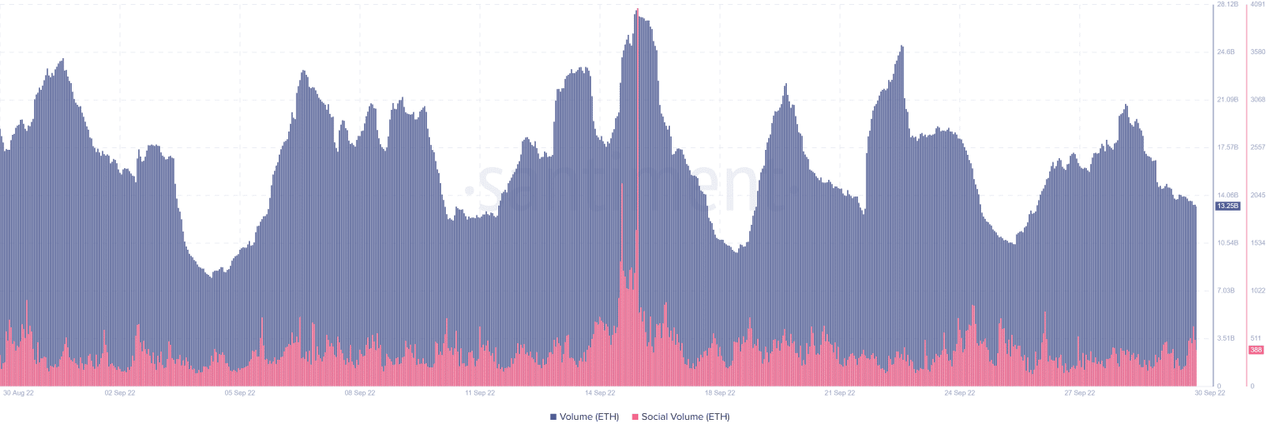

In the last three months, Ethereum [ETH] volumes have been all over the place, especially in September. Given the significant developments that have occurred in the crypto market this month, this may be an expected consequence.

The market for ETH has also been volatile during the last four weeks. Nonetheless, recent events have highlighted some interesting shifts that many investors may not have anticipated. Rising worldwide inflation, for example, has resulted in a stronger dollar and depreciation of certain major global currencies.

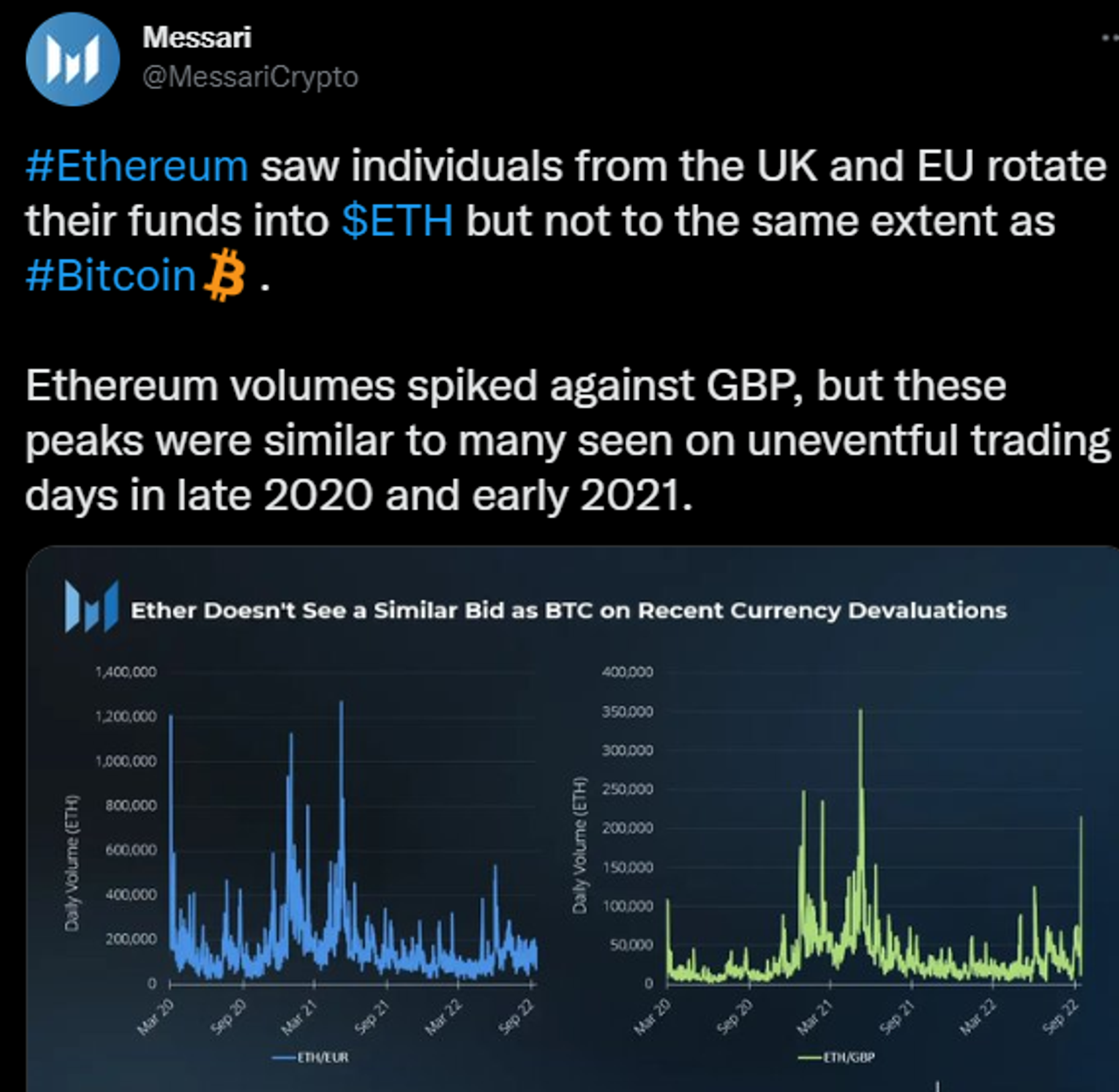

The Euro and the British pound (GBP) are two of the largest fiat currencies that have suffered. As a result of their depreciation, many people have been driven to seek new means of acquiring riches. According to Messari's research, Ethereum volumes against the GBP surged as investors rebalanced their portfolios.

Messari Twitter Feed

According to the research, the findings were more significant for BTC than ETH. It went on to say that the volume spikes were comparable to average volumes seen near the end of 2020 and in the first few weeks of 2021. The above observations were limited to the European market and did not reflect ETH's entire volume. Despite peaks and troughs, on-chain volumes have declined by a significant margin since mid-month.

Source: Santiment

Ethereum's social volume was also significantly lower than its mid-month levels. It managed a modest gain in the last 24 hours, which was a significant change given the cryptocurrency's present price level.

Ethereum has been in a price range of $1250-$1400 price for the last seven days. CoinMarketCap data shows that the asset is trading above the $1300 price level with a loss of more than 2%. The daily trading volume has also taken a hit by more than 40% resulting in a loss of 2% of its market cap.

CoinMarketCap

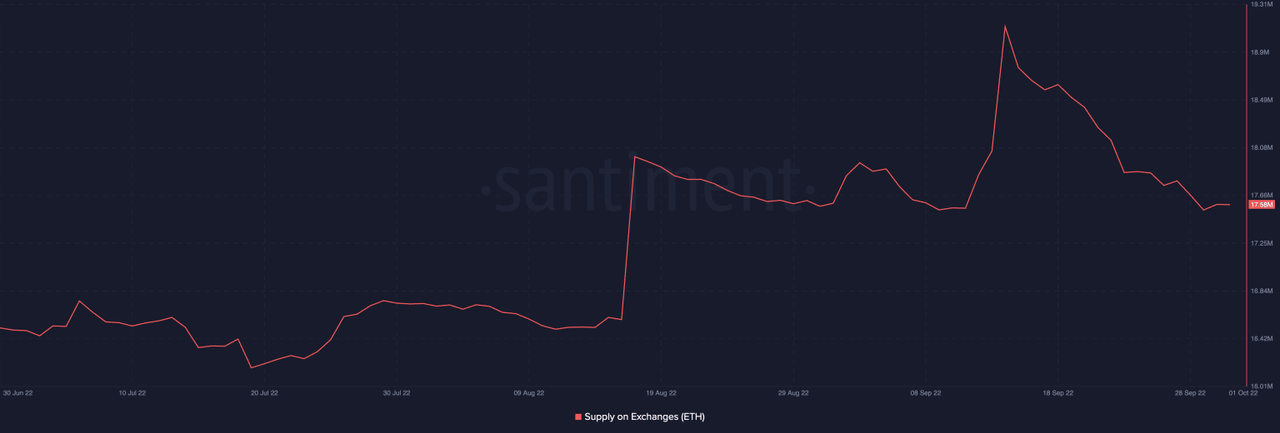

Holders spent the majority of Q3 transferring ETH to exchanges. Data from Santiment shows a three-month rise in the alt's supply on exchanges. Surprisingly, on September 15, this statistic ceased its increasing trend and began a downward trend.

This means that prior to the Merge, ETH holders distributed their coins. This was owing to the ambiguity around the success of the event.

However, coin accumulation resumed after the Merge’s successful conclusion. Furthermore, the amount of ETH sent into exchanges has significantly decreased. With the continuous drop in ETH supply on exchanges, the alt's price is projected to rise in Q4. ETH, on the other hand, had a statistically significant positive association with Bitcoin, an asset that many believe has not yet reached the bottom of the current bad market cycle.

Santiment

Furthermore, previously inactive ETH currencies began transferring addresses a month before the Merge, as indicated by the Mean Dollar Invested Age (MDIA) measure in Q3. While a drop in an asset's MDIA indicated strong network activity and was a harbinger of a price increase, the opposite was true for ETH.

As the MDIA plummeted (indicating higher activity), so did the price per ETH. ETH had continuous outflows in the three weeks preceding the Merge, as investors feared that the Merge would fail. Furthermore, inactive currencies switching addresses could be investors withdrawing long-held ETH from their wallets. Following the Merge, the MDIA began to rise, indicating that dormancy had returned to the ETH network.

TradingView

The influence of whale aggregation on the price of ETH cannot be over emphasized. According to Santiment statistics, major whales with 10,000 to 1,000,000 ETH coins gradually cut their ETH in the days leading up to the Merge. With the broader financial market declining and the cryptocurrency market following suit, these whales saw no need to return. Furthermore, it was then the obligation of asset dealers to drive up the price of ETH.

Buying pressure on the daily and 4H chart has weakened, making a huge bounce back in the short-term highly unlikely. Ethereum is consolidating and there’s no sign of when it will end. DYOR!!