Share on

- Copy link

Extreme selling pressure from the whales has ruined many traders’ expectations after ‘The Merge’. The Q3 report is out and Ethereum traders must consider these facts before going bullish on the asset.

Last updated Sep 23, 2022 at 08:53 PM

Posted Sep 23, 2022 at 04:00 PM

We will analyze the impact of the Ethereum merge and how it has changed the shape of the overall market. After this, we will delve into the Q3 report. Let’s get going!

How has the Merge impacted Ethereum?

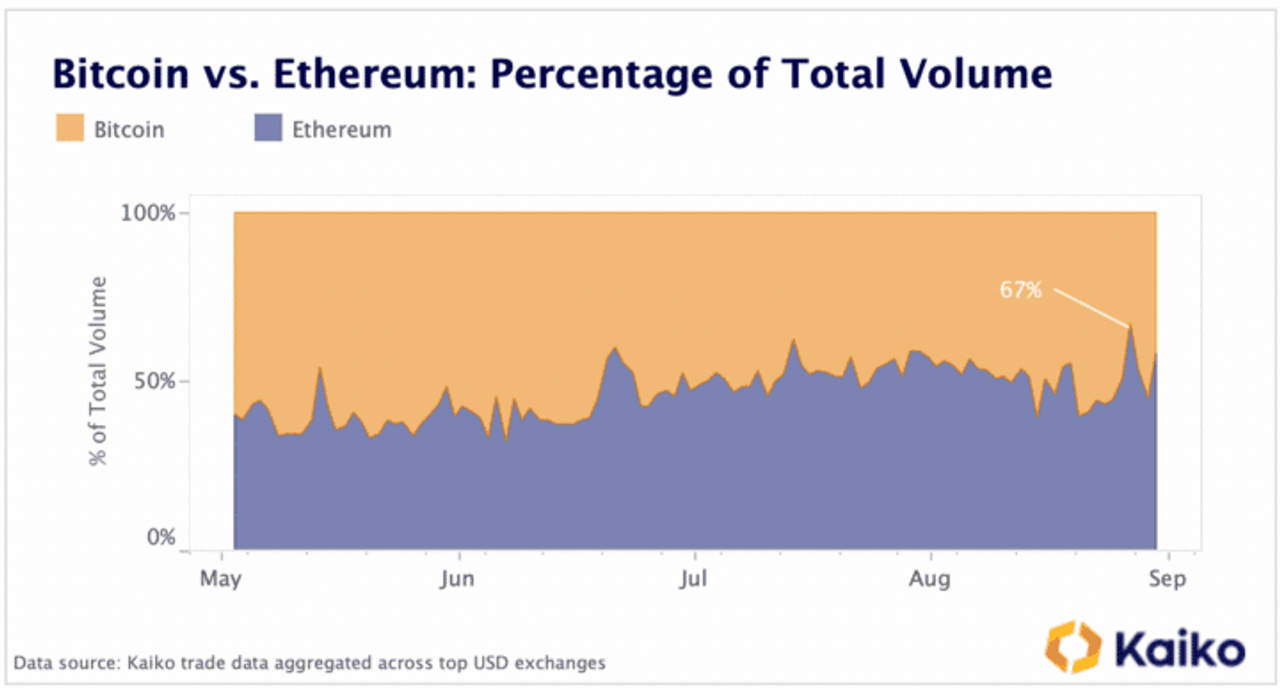

Everything changed when The Merge was eventually released on Ethereum (ETH) blockchain. What was supposed to be a significant bullish event has instead turned into a temporary source of anguish for traders of ETH. However, as Ethereum's trading volume share has reached a record high, the crypto market following the Merge is observing an odd trend reversal. The dominance of Bitcoin [BTC] in trading was ended by this pattern, leading to concerns of favoritism in the crypto sphere.

Source: Kaiko

In last week's sell-off, ETH accounted for almost two-thirds of the market share of the trading volume. For a while, the cryptocurrency market also noticed this change as ETH's market share tripled since 2020. This suggested a "durable shift" away from BTC in the market structure.

Let’s analyze the current market scenario for Ethereum.

Ethereum’s price has been showing extreme volatility and declines for the last seven days. Data from CoinMarketCap reveals ETH has lost more than 15% over the last two weeks. As of now, we are seeing some pullback in the Ethereum price with a gain of more than 1.5 % over the last 24 hours. The asset has added more than 14% to its daily trading volume. On September 19, the price of the asset tanked to as low as the $1280 price mark. This price change is a 180-degree shift from the expectations of Ethereum traders. It is yet to be seen whether ETH will change its direction or not.

CoinMarketCap

Let’s look at the performance report of Q3 to analyze what can happen next in the second-largest crypto ecosystem.

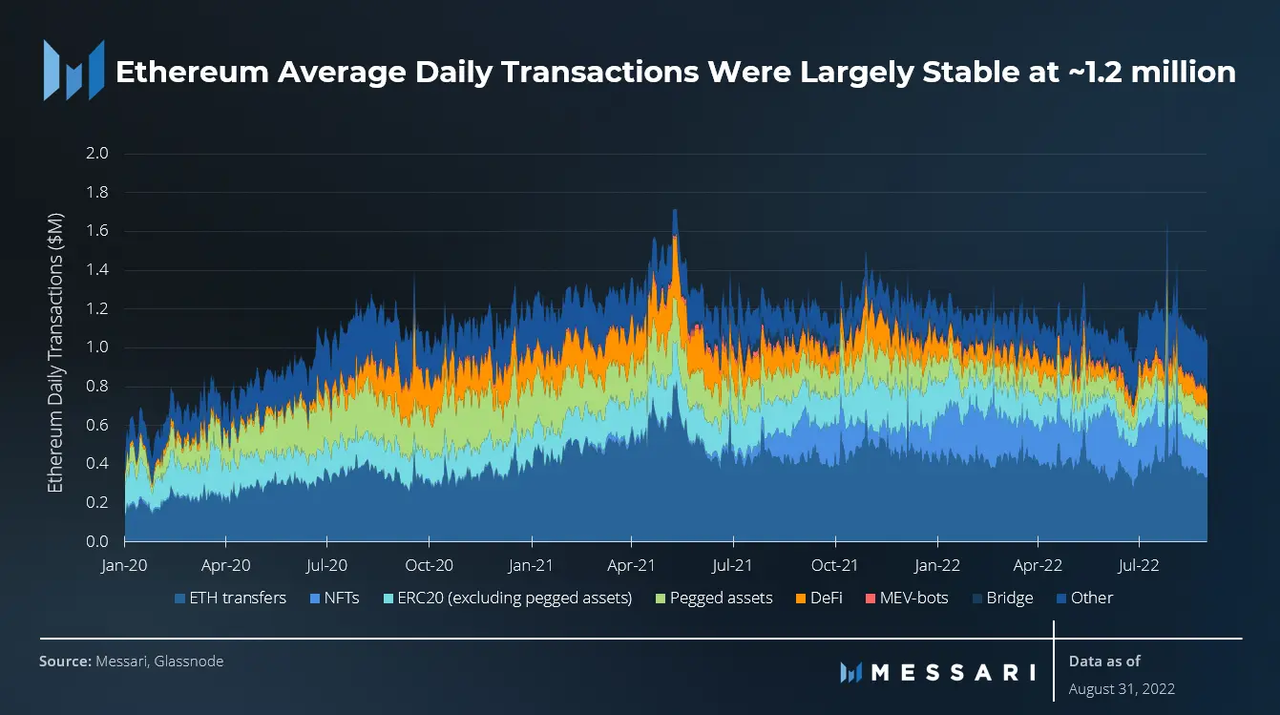

According to Messari report, there were 1.2 million transactions overall throughout the quarter. The increase from Q2 of 2022 was 6%. The report states that the growth in daily transactions over the quarter was 7% and 14%, respectively, for ETH transfers and DeFi transactions.

Additionally, during the quarter, there were more active addresses on Ethereum due to a rise in the average daily transaction volume. 550,000 daily active addresses were seen on the network, up 5% from the previous quarter.

Messari

Messari claims that the spike in active addresses on July 27 is what led to the overall increase in active addresses on Ethereum. At this time, Chandler Guo also disclosed Binance's "maintenance activity" and intentions for an Ethereum PoW fork.

According to Messari, the supply of ETH increased by 0.7%, or 4.2% annually, during the quarter. Furthermore, Messari discovered that since the official target block difficulty for the merging was established in July, the call volume for ETH has increased significantly on all exchanges.

Since 2020, ETH has been used in smart contracts, but the collapse of Terra in May stopped this progress. When Terra crashed on May 9th, 30% of the ETH was invested in smart contracts. Messari claims that the use of ETH in smart contracts has decreased since Terra's demise. Additionally, the network experienced a drop in revenue as a result of the L2s' increased activity during the quarter. Total fees on the network thus fell to their lowest point since 2020. A sustained decrease in network costs will directly affect the staking yields in the post-Merge future.

Messari

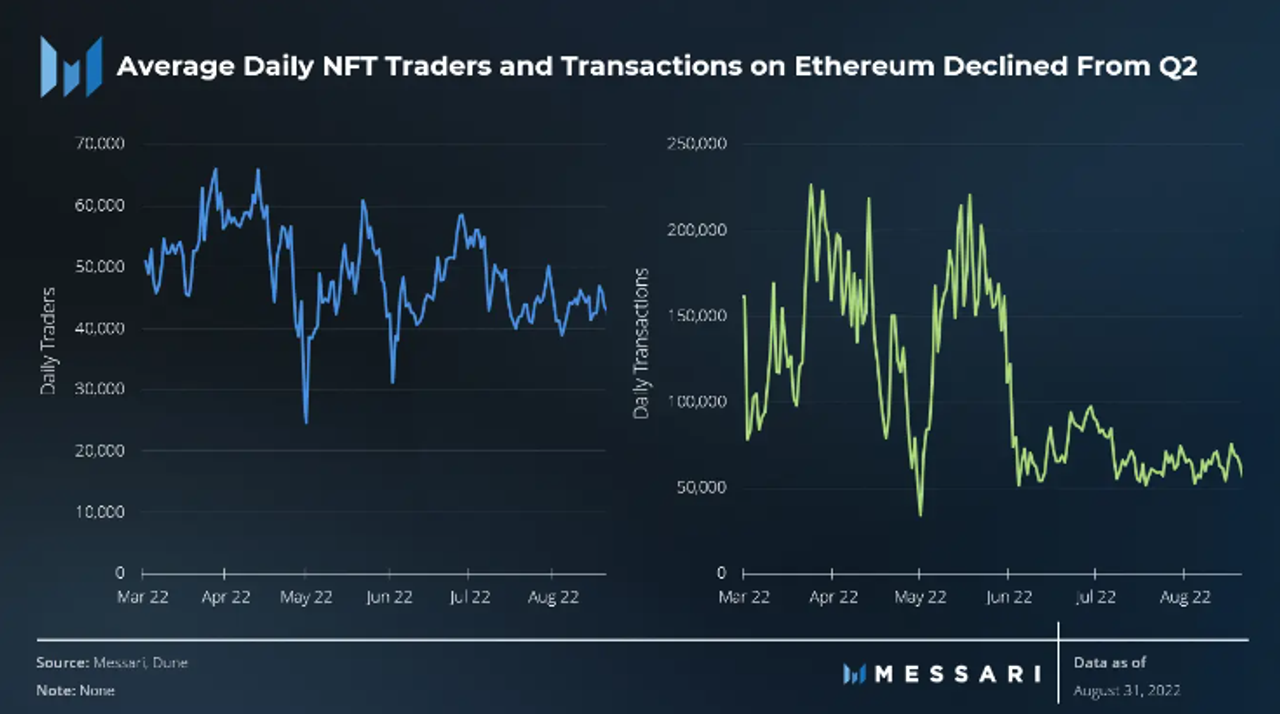

Over the quarter, Ethereum recorded 9,000 bridge transactions and 181,000 NFT transactions every day on average. Ethereum developers are concentrating on expanding the network for wider usage now that the Merge is over. Several network enhancements are anticipated following the Shanghai upgrade when pre-merge-staked ETH will be accessible for withdrawal.

If the price of Bitcoin drops, the Fair Value Gap (FVG), also known as the imbalance, will be filled at $1,234. A run-up, however, might be sparked by a spike in purchasers followed by a reversal in the major cryptocurrencies after the Federal Open Market Committee (FOMC) meeting. In such a scenario, ETH can ascend to the $1,550 immediate barrier level. The recently switched Proof-of-Stake token will be up against the high time-frame resistance level at $1,730 if this level can be successfully flipped.