Share on

- Copy link

Despite the skepticism in the financial world about crypto, you can generate crypto passive income. Crypto has created a stream of means by which users can easily utilize digital assets and make money.

Last updated Nov 2, 2022 at 03:13 PM

Posted Nov 2, 2022 at 02:46 PM

One of the most well-established current technologies is cryptocurrency. By eliminating the function of central banks in producing, distributing, and controlling currencies, it modified the traditional conceptions of money. Since their beginnings, cryptocurrencies have been viewed as a cryptic form of digital money. But financial institutions, businesses, governments, and individuals from all over the world have realized that cryptocurrencies have the power to revolutionize the established global financial system.

Individuals are searching for the best crypto passive income producers as a way to take advantage of the business opportunities offered by cryptocurrency. It's crucial to consider whether it's possible to use your crypto assets to generate passive income. You may find a summary of some of the top strategies for using cryptocurrency assets to generate crypto passive income in the discussion that follows.

Can You Make Crypto Passive Income?

Many bitcoin owners have overcome their fears and found ways to invest in and trade their digital money for lucrative rewards. The price of digital currencies fluctuates frequently, for example; this is only one of many significant problems that cryptocurrency investors must deal with. You also need to focus on maintaining your assets while keeping track of your cryptocurrency investments and investing portfolio.

Crypto Passive Income

You can see right away that investing in cryptocurrencies is everything but simple! The risk of losing your cryptocurrency investments is the first thing to consider. To ensure the best results, you must also cope with the complexity of investing in cryptocurrencies. Crypto Passive income may be the only way to avoid direct involvement in cryptocurrency investing.

By using a particular investment plan or placing your crypto assets on a particular platform, you can generate crypto passive income. You may find some amazing ideas to make your virtual currency assets work for you with the appropriate techniques and approaches. Sticking to your cryptocurrency, or "HODLing," is one of the most popular strategies for generating passive income on digital assets without any effort.

Storing a virtual currency on the expectation that its value would rise in the future, although, counts as a long-term plan. Traders who choose to "HODL" their cryptocurrency assets typically need to keep them for between six months and five years. As a result, "HODL" is not a cryptocurrency passive income producer.

Digital currencies can be a useful tool for earning crypto passive income, just like more conventional financial assets like commodities and equities. The finest cryptocurrency passive income producers, on the other hand, should focus on strategies other than cryptocurrency exchanges or storing their digital currencies for a long time.

The strategies for profiting passively from digital currencies must not include any kind of stakeholder participation that is active. Interestingly, there are numerous ways to make passive income from cryptocurrencies without having to keep up with the market. Here are some strategies for generating crypto passive income from your cryptocurrency holdings.

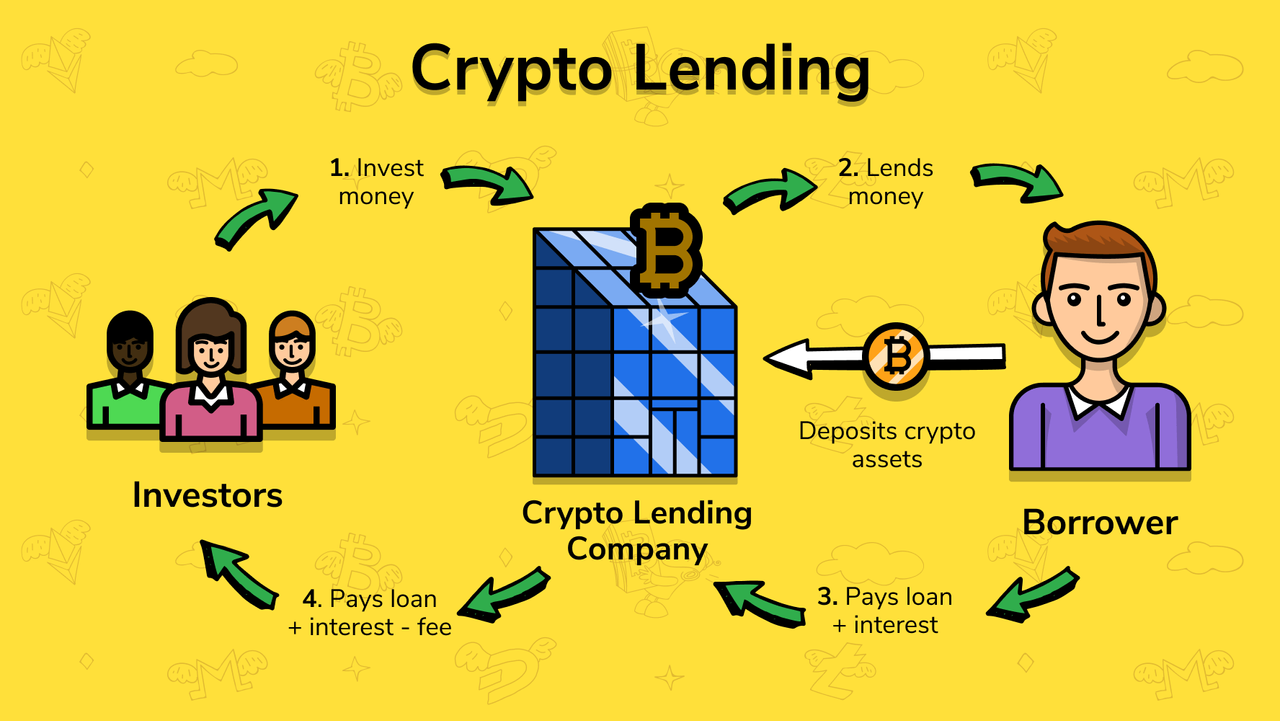

Lending is the initial and simplest way to generate an income stream from your crypto holdings. Crypto lending is, in reality, one of the best-liked activities in both the centralized and decentralized parts of the cryptocurrency environment. Through a variety of lending schemes, traders can lease their cryptocurrency holdings to lenders in exchange for income.

Crypto Lending Working

Peer-to-peer lending, margin lending, and DeFi lending are a few of the top crypto passive income streams for 2022. Here is a summary of each lending strategy tailored to meet the needs of various investors.

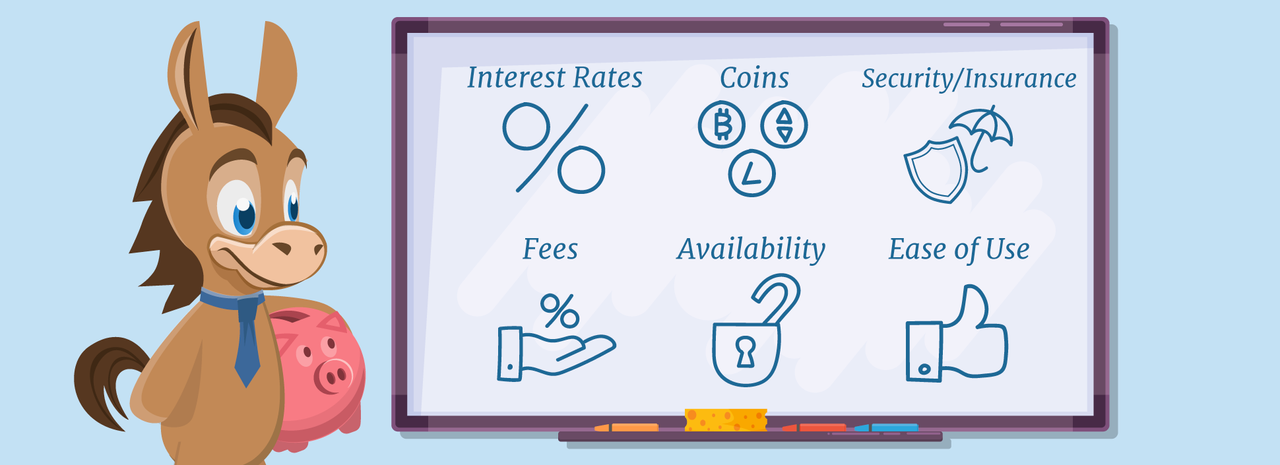

Interest-bearing cryptocurrency wallets also are prominent crypto passive income providers. The interest-bearing cryptocurrency accounts provide a convenient way to generate a predefined passive income from dormant cryptocurrency assets. Interest-bearing cryptocurrency accounts and conventional bank savings accounts have a lot in common.

Benefits of Crypto-Bearing Accounts

On several sites that provide these services, users can receive set income on their cryptocurrency investments. The interest-bearing cryptocurrency accounts allow customers to get revenue on a regular, weekly, monthly, or yearly basis. BlockFi, Celsius Network, and Nexo are a few examples of the greatest cryptocurrency passive income producers in interest-bearing digital asset accounts.

Some businesses provide users with digital assets in exchange for a portion of their cash. Depending on how many tokens you own, you can retain them and get a percentage of the company's profits. Because they provide a versatile approach for generating crypto passive income, dividend-bearing cryptocurrencies can therefore certainly be regarded as crypto passive income generators.

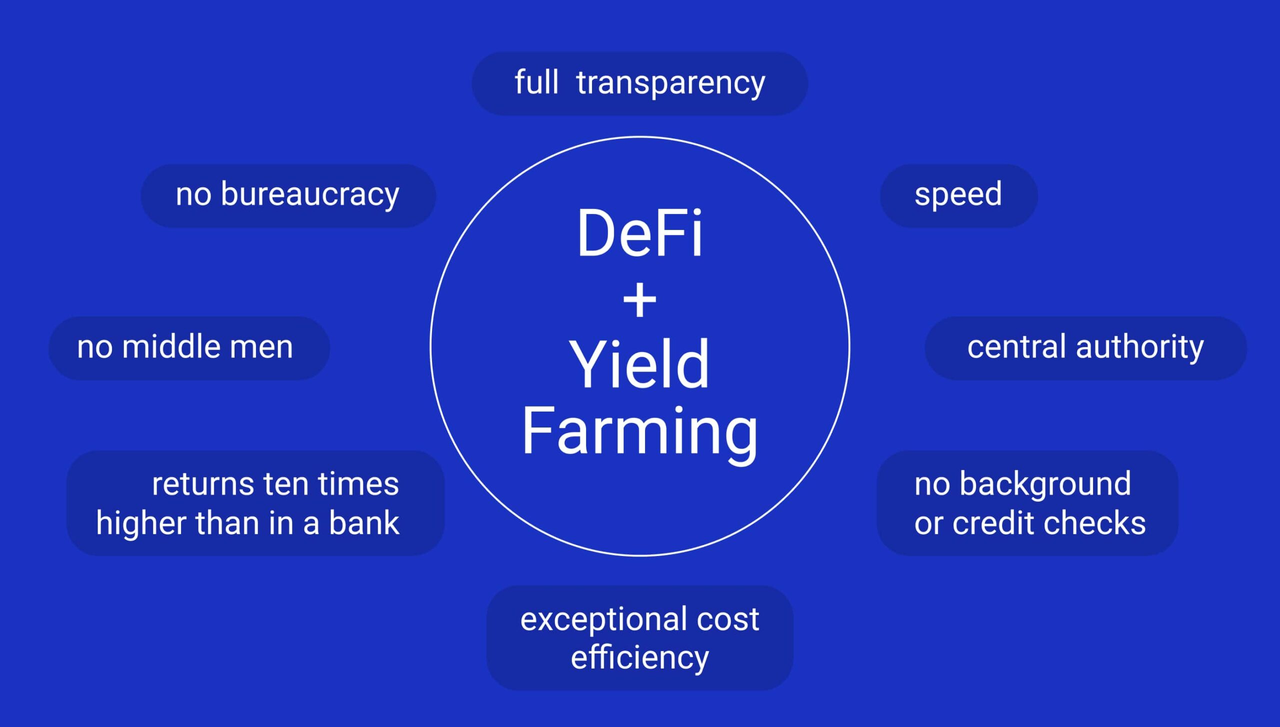

Yield farming comes in as the number two finest passive income source for cryptocurrencies. It is a decentralized way to make passive cryptocurrency income in DeFi, and it has been greatly influenced by the lively activities of decentralized exchanges. DEXs have developed into thriving financial products that depend on shareholder liquidity and smart contracts. In DEXs, users are not required to deal with agents or other participants.

Instead, you can communicate with liquidity providers, sometimes known as smart contract-based liquidity pools or collections of investor-deposited cash. A specific portion of the trading expenses incurred by the pool is distributed to the liquidity providers.

Benefits of yield Farming

Anyone can start yield farming in 2022 as a liquidity supplier on several DeFi platforms, which is one of the trustworthy crypto passive income sources. Trustworthy decentralized exchanges like Uniswap are the ideal for beginning yield farming in the cryptocurrency industry. By adding a certain proportion of two or more virtual currencies to liquidity pools on the platforms, you can start providing liquidity.

Tokens known as LPs, or liquidity providers, would be given to you by the decentralized exchange in return for your participation in the liquidity pool.

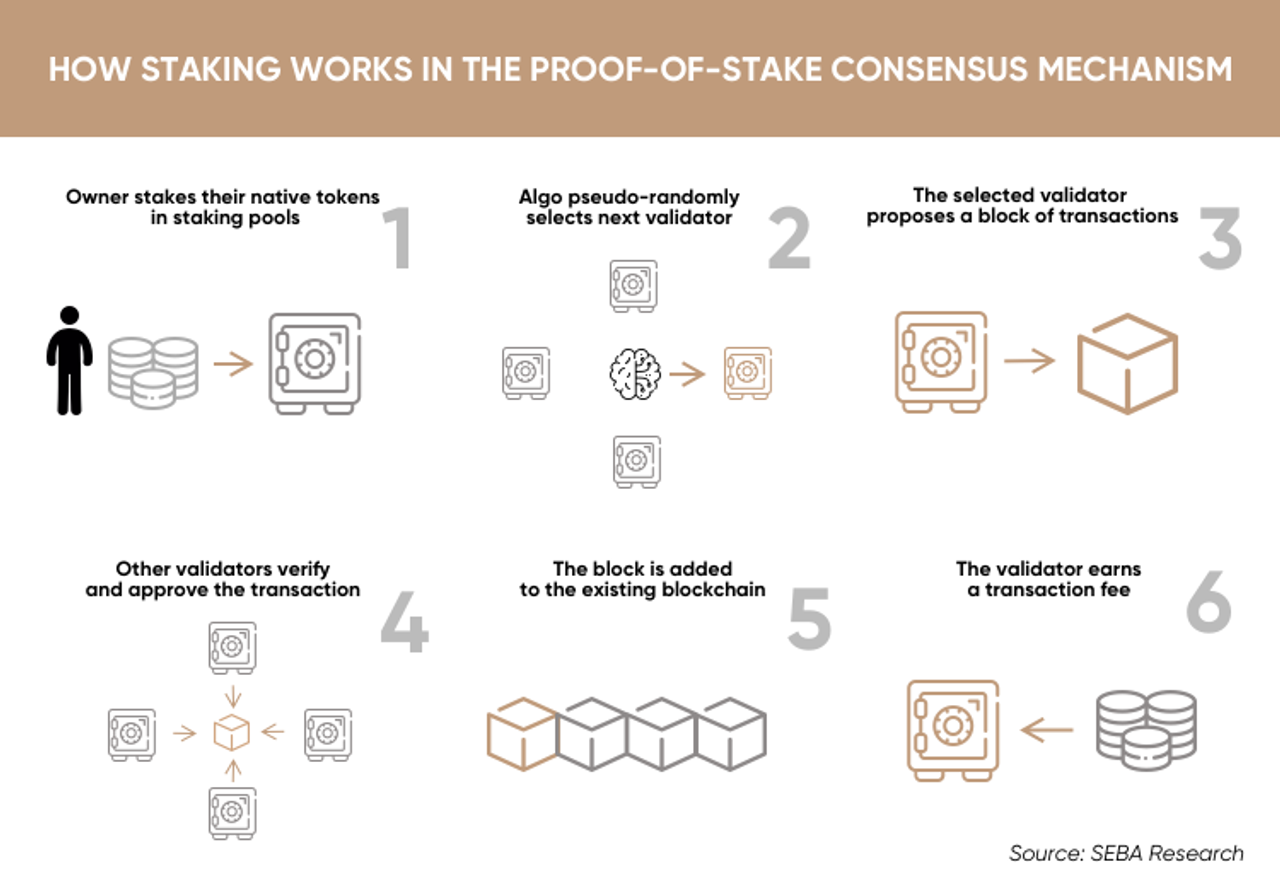

Staking became an important source of cryptocurrency passive income in 2022. Blockchain technology's innovative Proof of Stake consensus method has been designed to grant system users administrative abilities. The community-based strategy seeks to allay the problems with centralized involvement.

Working of Staking

The Proof of Stake blockchain systems selects verifiers from a large user base. To receive a return on their pledged resources, individuals must stake a certain amount of the native cryptocurrency asset. To make cryptocurrency passive income without hassle, you can also decide to stake on PoS blockchains like Ethereum 2.0, Solana, and Polkadot.

The many possibilities for creating passive cryptocurrency income offer distinctive chances and use different techniques. However, you must begin with a fundamental understanding of the risks of investing in cryptocurrencies.

Be ready for the volatility in the price of cryptocurrencies. But don’t ignore the possibility of the best passive income sources for cryptocurrencies now available. Investigate the best methods for utilizing your cryptocurrency assets to get the best results.