Share on

- Copy link

Initial Coin Offerings have gained popularity as a method of raising funds and offer the potential for significant profits for both companies and investors. The lack of regulation in this field means that there is a high level of risk involved.

Last updated Jan 23, 2023 at 02:14 PM

Posted Jan 23, 2023 at 02:00 PM

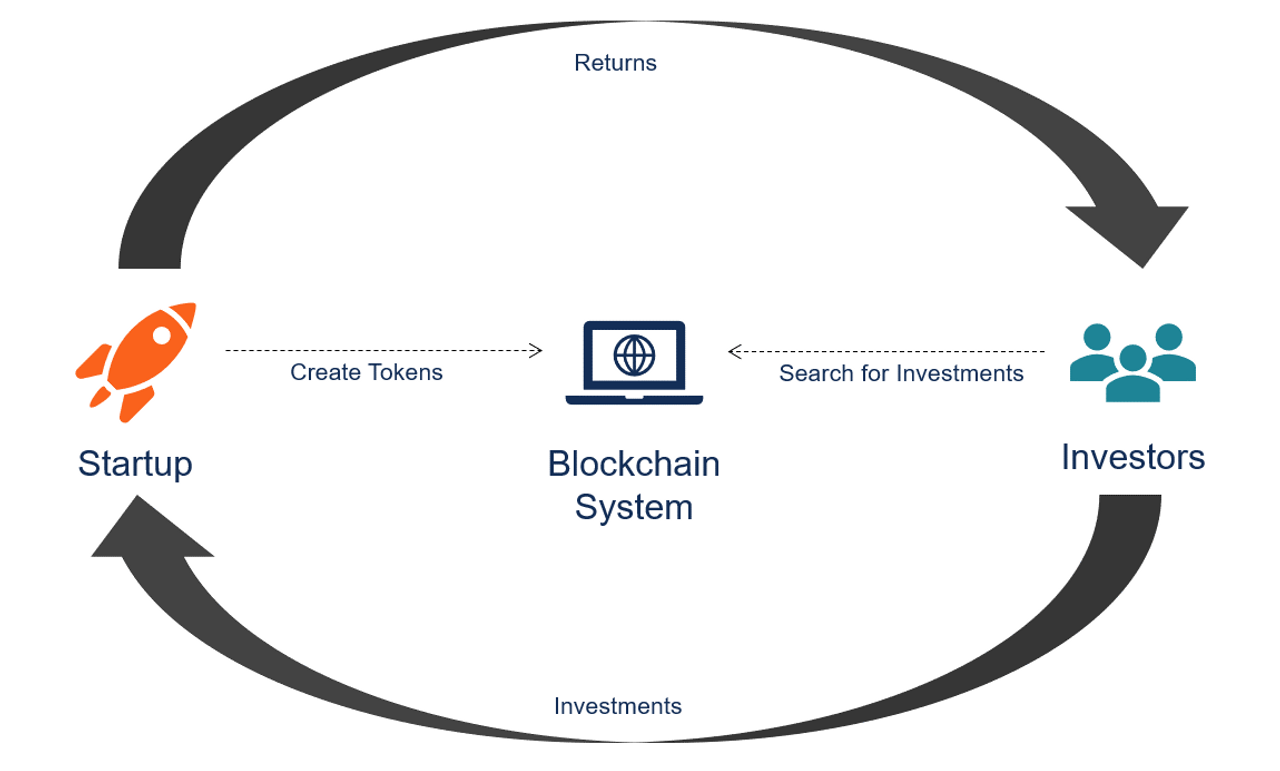

An initial coin offering (ICO) is a type of capital-raising activity in the field of cryptocurrencies and blockchain technology (ICO). The ICO can be thought of as a cryptocurrency-based initial public offering (IPO), but that is not the most accurate comparison because there are some significant differences between the two fundraising strategies. Startups typically use an ICO to raise funds.

A new cryptocurrency token that the corporation has issued can be obtained by participating in an initial coin offering by interested investors. This token might be useful for the good or service that the business is providing, or it might signify ownership of the business or project.

The primary benefit of ICOs is the elimination of intermediaries from the capital-raising process and the establishment of direct relationships between the company and investors. Additionally, both parties' interests are congruent.

Below is a list of the two types of initial coin offerings:

Only a select group of investors may take part in private initial coin offerings. Private ICOs frequently restrict participation to approved investors (financial institutions and high-net-worth individuals), as a company may set a minimum investment threshold.

Initial coin offerings (ICOs) that are open to the public are a type of crowdfunding. The public offering has democratized investment because virtually anybody can invest. However, due to regulatory concerns, private ICOs are becoming more tempting as compared to public offerings.

The popularity of ICOs is increasing as a result of the development of cryptocurrencies and blockchain technology. Over $7 billion was raised in 2017 through ICOs. The amount roughly doubled in 2018. Telegram, a provider of instant messaging services, conducted the largest ICO to date. During a private ICO, the UK-based company raised more than $1.7 billion.

An initial coin offering is a complex procedure that calls for a thorough understanding of technology, finance, and the law. Utilizing the decentralized networks of blockchain technology in capital-raising activities that will harmonize the interests of many stakeholders is the main goal of ICOs. The following is a list of the ICO's steps:

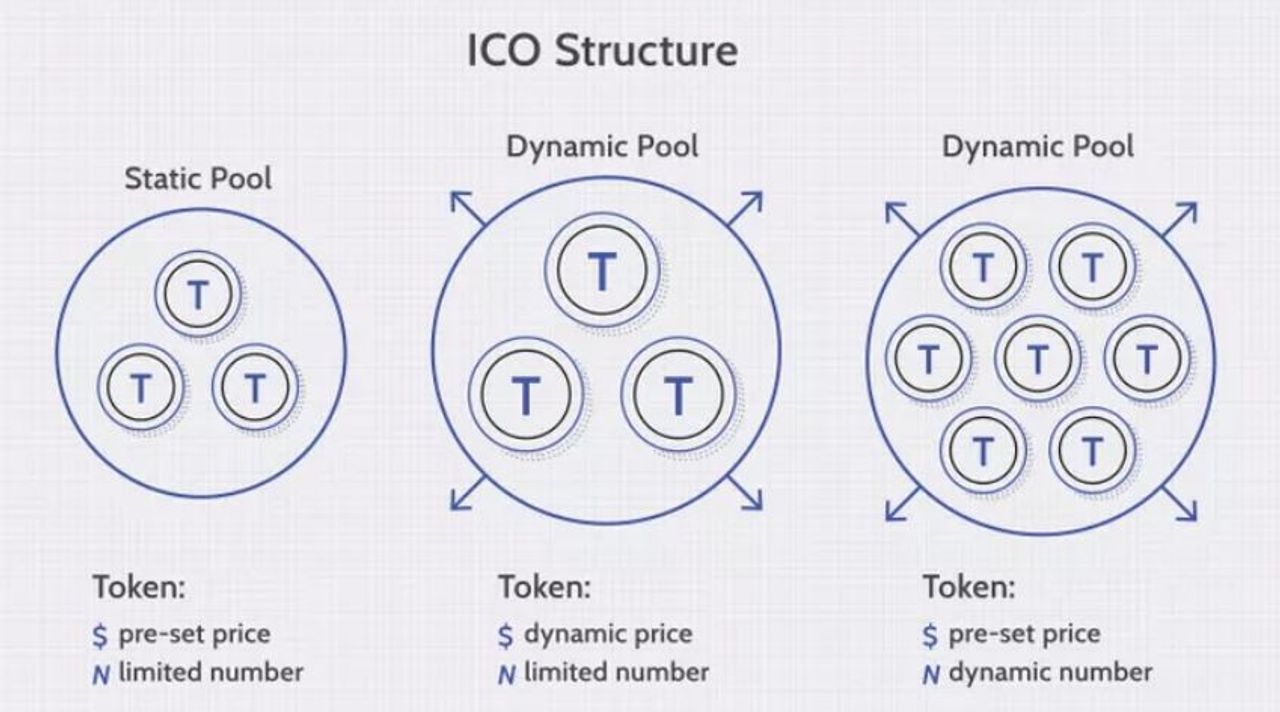

• Static price and static supply: Each token sold in the ICO has a specified price, the overall token supply is fixed, and a company can set a certain financial target or limit. • Dynamic price and static supply: A static token supply and a dynamic funding target are both possible in an ICO; in this case, the price per token will depend on the amount of money raised. • Static price and dynamic supply: Some ICOs feature a dynamic token supply but a fixed price, which means that the supply is determined by the amount of financing raised.

Along with conducting the ICO, the crypto project will often publish a white paper, or pitchbook, which will be made available to potential investors through a new website created expressly for the coin.

The project's promoters include the following key details about the ICO in their white paper:

• The purpose of the project. • The requirement that the project would satisfy after it was finished. • Cost of the project. • How many of the virtual coins will be kept by the founders. • Which payment methods and currencies are accepted. • The duration of the ICO campaign.

To entice enthusiasts and supporters to purchase some of the project's tokens, the project releases the white paper as a part of its ICO campaign. The new tokens can typically be purchased by investors using fiat or digital currency, though it's becoming more typical for investors to pay using other types of cryptocurrency like Bitcoin or Ethereum. These recently released tokens are comparable to stock shares offered to investors during an IPO.

Anybody can start an ICO. Anyone with access to the necessary technology is free to establish a new coin because there is currently very no regulation of ICOs in the United States.

However, this lack of regulation also means that someone could go to any lengths to convince you that their ICO is real so they can steal your money. Out of all the fundraising avenues, an ICO is likely the easiest to set up as a scam.

The initial coin offering is a brand-new technological and financial breakthrough. Recent capital-raising procedures have been significantly impacted by the introduction of ICOs. The emergence of this new fundraising model in finance took regulatory bodies everywhere off guard. Different nations take different approaches to the regulation of initial coin offerings. For instance, ICOs are not permitted by the governments of China and South Korea. Along with the United States and Canada, numerous European nations are developing special legislation to control the operation of ICOs. In addition, ICO regulations have already been established in several nations, including Australia, New Zealand, Hong Kong, and the United Arab Emirates (UAE).

Although there are legal requirements, an ICO is simply a kind of financing in which a firm issue its own digital currency in return for the biggest of them all: Bitcoin. An ICO can be thought of as a digital IPO or initial public offering for a company. In June, a new company by the name of Bank Core allegedly received over $150 million from unidentified investors in less than three hours.

Although businesses can skip the regulated fundraising process that is often required of them by banks and venture capitalists, doing so can raise serious issues if you're looking to buy a cryptocurrency. Watch out for these warning signs.

To minimize the risk of investing in an ICO, it's important to conduct thorough research on the project and the team behind it. This includes reading the whitepaper, reviewing the code, and checking out the team's background and experience. It's also important to be aware of any red flags, such as a lack of transparency or unrealistic claims. Despite the risks, investing in ICOs can also be a great opportunity for high returns. Many successful ICOs have generated returns of 100x or more, making them a potentially profitable investment. Additionally, investing in an ICO can give you access to early-stage projects that could become major players in the industry. To maximize the potential returns of investing in an ICO, it's important to invest in projects that you believe in and that have a solid business model and a good team behind them. It's also important to have a clear understanding of the market and the project's potential for growth.

Investing in ICOs can be risky, but doing so can also be a great opportunity for high returns. It's important to conduct thorough research on the project and team, be aware of red flags, and have a clear understanding of the market and potential for growth. As with any investment, it's crucial to invest only what you can afford to lose.