Share on

- Copy link

Day trading can be both profitable and risky. This article gives proven strategies to maximize profits and minimize risks for day traders.

Last updated Feb 13, 2023 at 05:30 PM

Posted Feb 13, 2023 at 03:03 PM

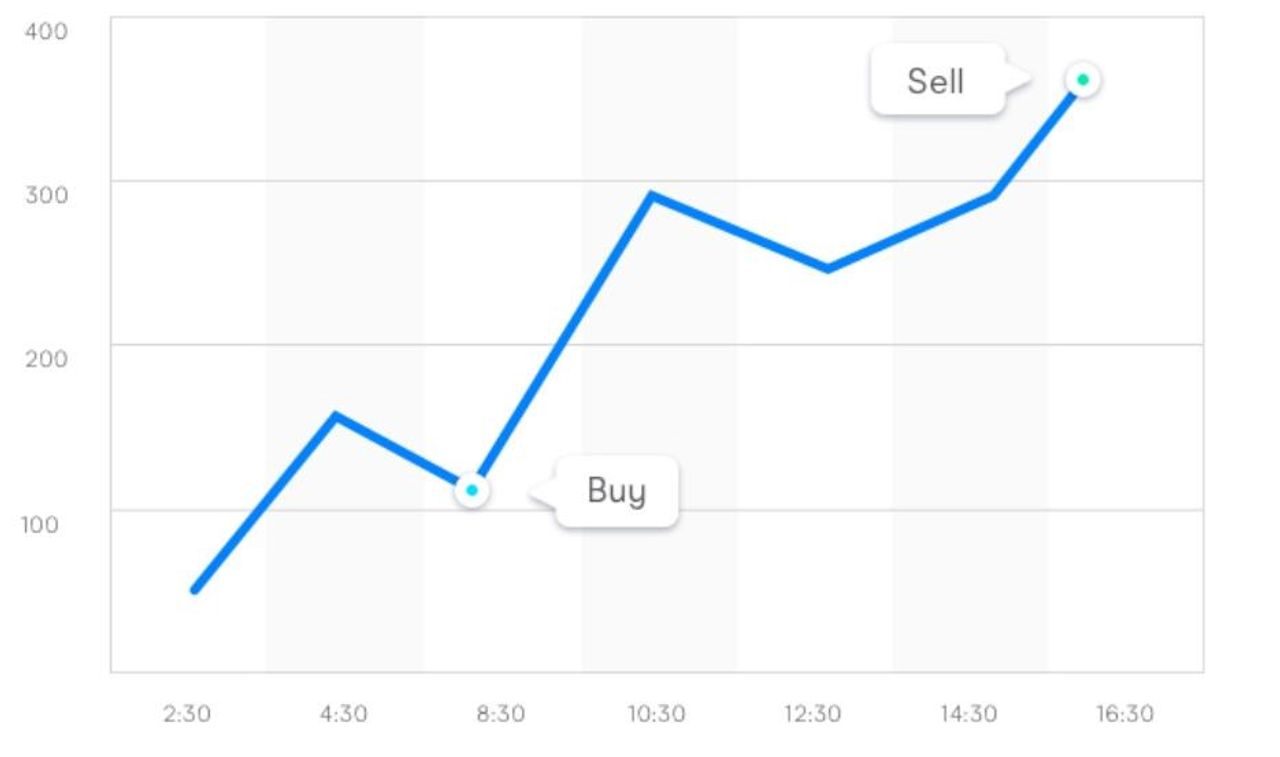

Intraday or day trading involves purchasing and selling financial instruments within a single day, or even several times within the same day. If executed correctly, this practice has the potential to be a profitable venture. However, it can pose a risk to those who are new to it or don't follow a well-planned strategy. Day traders take advantage of changes in market prices that occur during the opening and closing hours of the market. They typically open multiple positions within a day but avoid holding them overnight to reduce the risk from market fluctuations that occur during non-trading hours. A well-structured trading strategy that can adapt to rapidly changing market conditions is recommended for day traders.

• No overnight risk. By its definition, intraday trading mandates that no trade remains open past the end of the trading day. • Intra-day risk is limited. Day traders typically engage in short-term trades that last between 1 to 4 hours, reducing the potential risks associated with longer-term trades. • Time-sensitive Trading. Day trading might be suitable for individuals seeking flexibility in their trading. During the course of a day, a day trader may initiate 1 to 5 trades and close all of them when their targets are met or when they are stopped out. • Various trade opportunities. A day trader can trade in both local and international markets and can enter and exit numerous trades within a single day, taking advantage of the24/7 forex market hours.

There are numerous day trading strategies for beginning traders. Understanding these strategies is essential for a successful and enjoyable day trading experience. Successful traders often rely on a few preferred strategies, but what works for one person may not work for another, so it's valuable to learn a variety of them in the beginning. The strategies listed below will assist you in achieving long-term success as a day trader.

Aside from being familiar with day trading practices, it's also important for day traders to stay informed about the latest stock market news and events that impact stocks, such as announcements from the Federal Reserve System regarding interest rates, leading indicators, and other economic, business, and financial news.

Therefore, it's important to do thorough research. Create a list of stocks you are interested in trading and stay informed about the specific companies, their stocks, and the broader market. Keep up with business news by regularly reading online news sources that you trust.

Evaluate and determine the amount of capital you're willing to risk in each trade. Many successful day traders risk only a small portion, typically between 1-2%, of their account per trade. For example, if you have a $40,000 trading account and are comfortable risking 0.5% on each trade, your maximum loss per trade would be $200 (0.5% of $40,000). Set aside extra funds that you are willing and able to trade with and are prepared to potentially lose.

Day trading demands dedication and attention. It will take up the majority of your day, so it is not suitable if you have limited hours to spare. As a day trader, you need to stay vigilant and monitor the markets, always ready to seize opportunities that may arise at any point during trading hours. Swiftness and alertness are essential traits for success in this field.

As a beginner, concentrate on monitoring and investing in a maximum of 1 or 2 stocks per trading session. This will make it simpler to spot opportunities and keep track of your investments. A recent trend in day trading is the ability to trade fractional shares, allowing for smaller investments with specified dollar amounts.

Many brokers now offer the option to trade fractional shares, which allows you to invest smaller amounts. For example, if the shares of Amazon are being traded at $3,400, you can purchase a fraction of the shares for an amount as low as $25, which is less than 1% of the cost of a full Amazon share.

Avoid investing in penny stocks, as they often lack liquidity and the likelihood of profiting from them is low.

Stocks that trade for less than $5 a share may be delisted from major exchanges and can be traded only in the over-the-counter market. Unless you have thoroughly researched a potential opportunity, it is best to steer clear of these stocks.

In the morning when the markets open, there is often high activity from investors and traders placing orders, leading to price fluctuations. Experienced traders may be able to identify patterns and make profitable trades. However, those new to the game might be wise to observe the market for the first 15 to 20 minutes before making any moves. The midday hours tend to be calmer, with increased activity again towards the close. Although there are opportunities during peak hours, it may be safer for beginners to avoid them initially.

Choose the type of orders you'll use for buying and selling stocks. The options are market orders and limit orders. Market orders are executed at the current market price, without a set price. This is useful if you simply want to buy or sell without worrying about the exact price. Limit orders, on the other hand, allow you to set the price at which your order will be executed, providing you with more control and precision in your trades. However, your order won't be filled if the market price doesn't reach your set price.

A profitable strategy doesn't have to always be successful. Even if traders profit on only 50-60% of their trades, as long as they make more on their winning trades than they lose on their losing trades, they can still come out ahead. It's important to have a clear definition for entering and exiting trades and to limit the financial risk on each trade to a set percentage of your account.

When the stock market becomes challenging, a day trader needs to remain level-headed and make decisions based on reason and logic, rather than being swayed by emotions such as greed, hope, or fear.

To be successful in day trading, you need to act quickly but make decisions based on a pre-planned strategy, rather than allowing emotions to dictate your moves. It is important to stick to your plan and not deviate from it, even in the face of challenges. Remember, the key to success is to have a well-thought-out plan and to stick to it.

Day trading can be challenging to master, as it demands patience, expertise, and self-control. Many aspiring traders fail, but using the aforementioned tactics and methods might increase your chances of establishing a profitable strategy. Day traders, whether they work for a financial institution or trade as individuals, are crucial in maintaining market efficiency and liquidity. Continuously acquiring skills, evaluating performance, and gaining experience increase the chances of making successful trades.