Share on

- Copy link

The Year in Crypto 2022 was a more of downs than ups however this intense bearish market market acted as cleansing for the crypto market.

Last updated Jan 4, 2023 at 11:17 PM

Posted Jan 4, 2023 at 09:44 PM

2022 has been a tumultuous year for investors, with the U.S. stock market suffering a substantial decline and bonds and cryptocurrencies both crashing over 50% from their respective peaks in 2021. Uncertainty is high across global markets, presenting unique challenges to those navigating these choppy waters.

In the crypto sphere, a number of leading firms suffered major financial losses while plummeting prices rocked digital currency markets across the globe.

After multiple years of warning about the pitfalls of cryptocurrency, 2022 saw a string of events that supported many warnings. In May, we witnessed an ecosystem collapse on LUNA, followed by the FTX the exchange’s disastrous November outcome – followed by optimism in the crypto industry: Ethereum merge!

So the end-of-year holiday season is an opportunity to take stock after one of the most challenging years in recent memory and look ahead toward brighter days on the horizon.

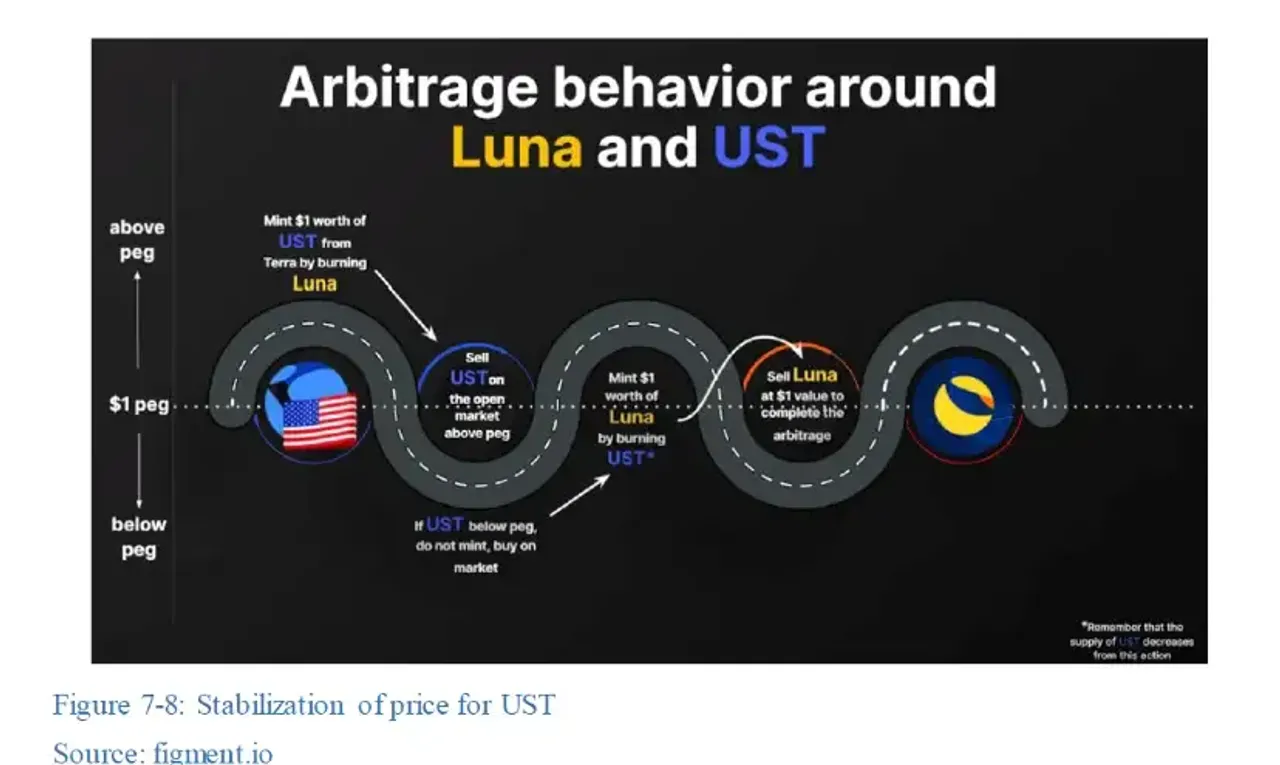

Terraform Labs, was founded in 2018 and headquartered in South Korea’s capital Seoul, made headlines when it launched the innovative LUNA system alongside its companion stablecoin UST. Their concept of an ‘algorithmic stablecoin’ was unique compared to other existing coins, such as USDT and USDC, with LUNA burning whenever UST loses its 1:1 peg against the dollar or vice versa. CEO Do Kwon inspired this revolutionary invention which has been making waves ever since.

But mystery surrounded the Terra Network in May 2022 when its price suddenly plummeted. Big-shot investors had driven the algorithmic stablecoin, which was worth $18 billion at its peak, to the highest tier of crypto success. Yet within a few days on May 7th and 9th, Terra USD fell from its peg of one dollar down to 35 cents while LUNA dropped all the way from an impressive figure of almost 80 dollars to just a few pennies by the 12th.

This tragedy left many scratching as they tried to determine how the millions of dollars of investors’ savings evaporated in no time. Before the LUNA crash, immense sums of UST were withdrawn from Anchor Protocol and sold off in short order. The precise reason for this activity is yet unclear. However, some observers believe it may have been a purposeful strike against Terra’s ecosystem.

This blackout sale caused an abrupt decrease in price per unit coin, plummeting to just 91 cents USD. Taking advantage of these conditions, shrewd investors began purchasing large amounts of LUNA at hugely discounted prices before its value had time to recover.

As the cryptocurrency marketplace faced a significant decline, LUNA was not spared as its price plummeted. This posed further turmoil with UST, which had been algorithmically tied to LUNA for stabilization. Ultimately, when UST’s total value could no longer be redeemed against LUNA due to market capitalization dipping, holders rapidly lost confidence in it. They began selling off, causing an accelerated devaluation of both currencies.

After prolonged legal proceedings, difficult decisions, and tumultuous transition periods, the serial entrepreneur finally achieved their ultimate goal - acquiring the social media platform. The past months have seen a whirlwind of events since Elon Musk assumed ownership of Twitter: Employees were laid off en masse, and engineers were fired for criticism, leading to the company’s stock plummeting. It marks a period unlike any other in Twitter history, following Musk’s initial proposal earlier this year to take control of the platform.

On Apr 5th, Elon Musk publicly revealed his acquisition of a substantial portion of Twitter shares. Though initially offered to join the Board, this offer was quickly retracted to fend off a “hostile takeover” by Musk. Subsequently, Mr. Musk proposed the purchase of Twitter for $44 billion – which was above its current market price at that time – expressing interest in utilizing principles surrounding free speech as he believed it had been wrongly managed thus far.

Later on, Elon Musk announced plans to finance a deal through cash and loan acquisition, causing shares in his automotive business Tesla to plummet by the middle of November. Subsequently losing almost half their value, these downward trends have raised serious questions amongst investors and those involved with the company.

It was followed by Elon Musk’s claims of Twitter covering up a profusion of bot and spam accounts garnered no response or reprieve. As a result, Twitter pursued legal action against tech mogul Elon Musk in a Delaware court, seeking to enforce its $44 billion offer.

After Elon Musk completed the contentious acquisition of Twitter, and swiftly took control with a dramatic change in management. Executives have been removed from their positions as he steers the business toward his vision for success.

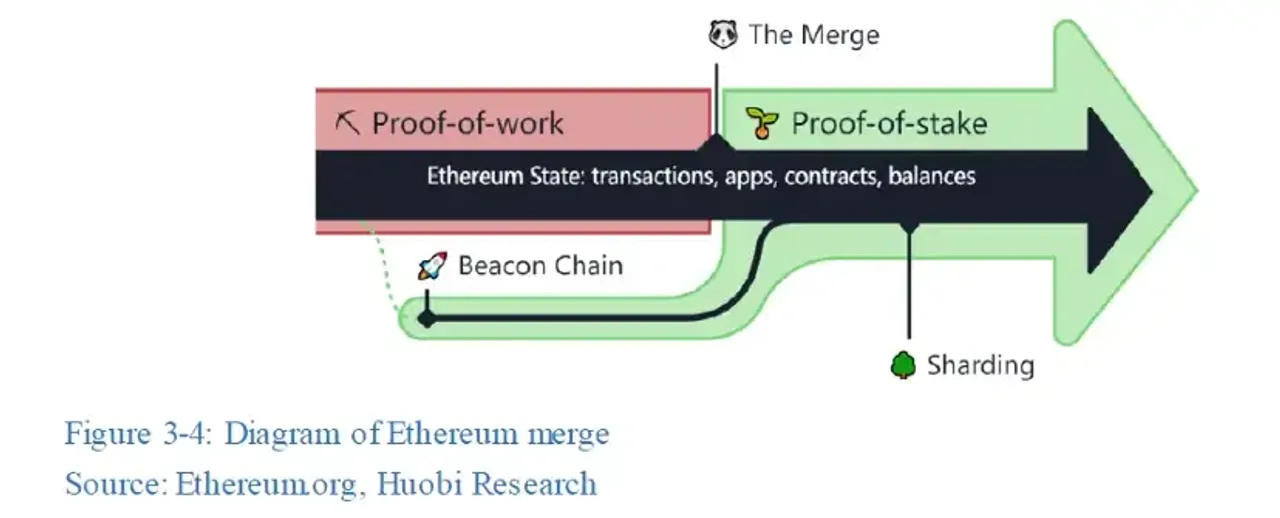

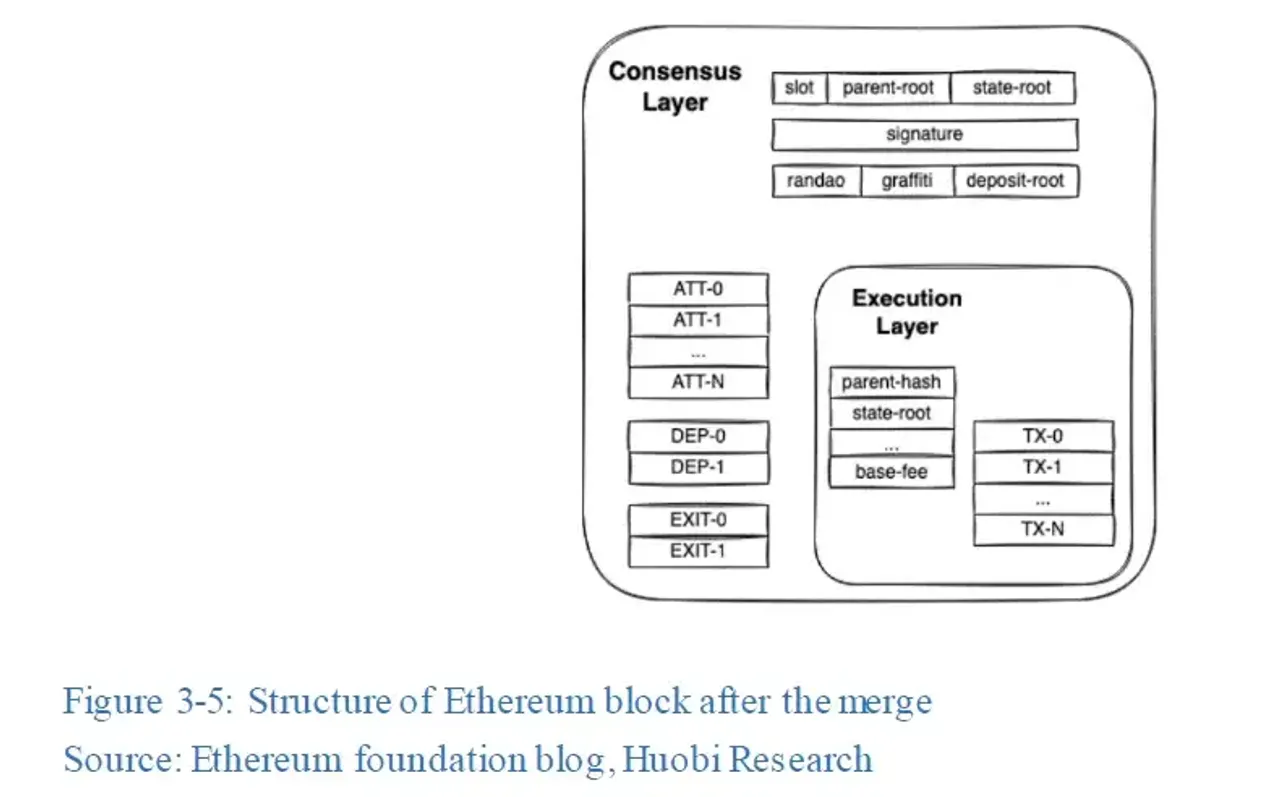

ETH is making a groundbreaking transition from mining-based proof-of-work to a more efficient, scalable proof-of-stake (PoS) system. The Merge will enable integration between Ethereum’s mainnet and its Beacon Chain - an energy-conscious PoS Layer that facilitates this significant updating of the blockchain consensus mechanism.

Ethereum powers the development of innovative dApps and crypto assets, allowing blockchain developers to unleash their creativity. Boasting the second-highest market cap in its industry, Ethereum is a mainstay of technological progress in the cryptocurrency world.

Before the Merge, Ethereum’s blockchain was safeguarded with an energy-intensive Proof of Work system. Here miners would race against one another to solve a challenging mathematical equation in order to verify and add transactions sent over the network - their reward being a cryptocurrency incentives.

After Ethereum’s successful Merge, network miners will be replaced by stakers who secure their ETH tokens to authorize transactions. As a result of this major upgrade, it is anticipated that the energy consumption on the blockchain system will reduce significantly by more than 99.5%.

Furthermore, The Merge paves an exciting path for further the improvement in scalability can now be achieved with the Proof-of-Stake consensus model, and various other advancements, such as sharding, could be possible soon. It would significantly accelerate transaction speed while managing heavy congestion efficiently at the same time.

StartFragment

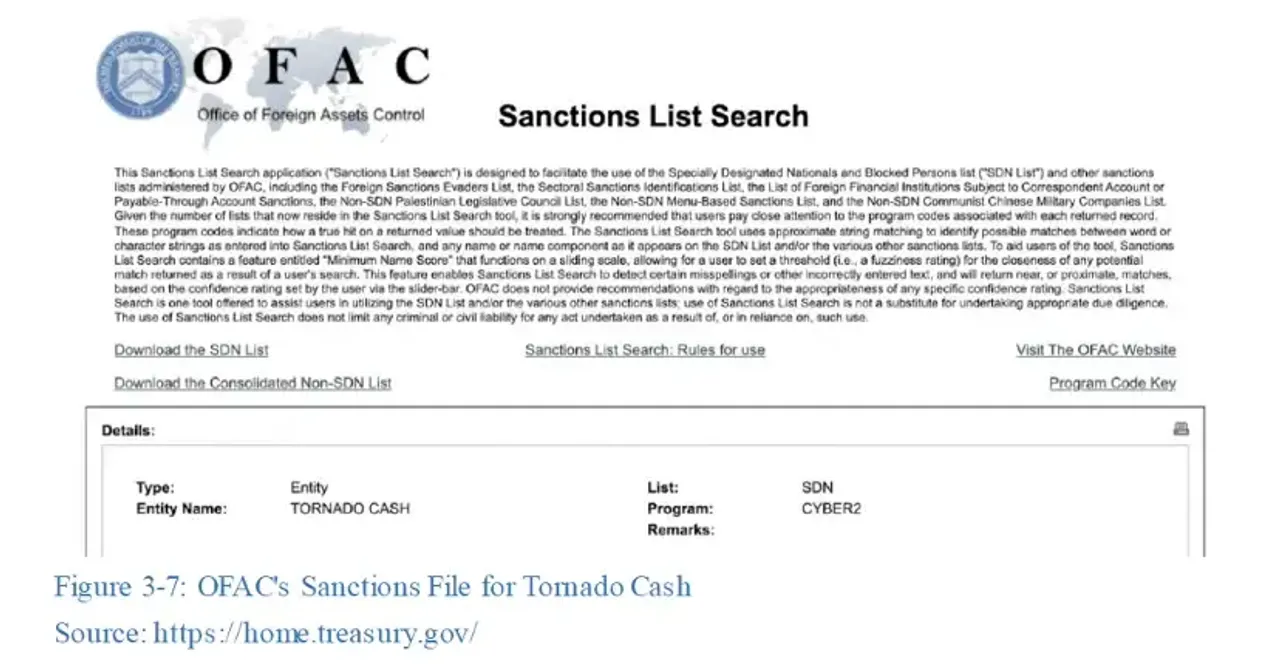

On Aug 8th, a significant milestone was reached in the fight against cybercrime when U.S Treasury-sanctioned Ethereum smart contract mixer Tornado Cash faced repercussions for its involvement in laundering over $455 million worth of cryptocurrency obtained by North Korean-affiliated hacking organization Lazarus Group.

Since its launch in August 2019, Tornado Cash has mixed an impressive $7.6 billion worth of Ether transactions; however, a significant portion (30%) is tied to potentially illicit actors. Complicating the matter even further is the non-custodial nature and smart contract encoding of this decentralized platform which makes traditional sanctions compliance difficult. Cryptocurrencies and other blockchain assets were regularised worldwide.

Tornado Cash is a practical and legitimate solution for users who wish to preserve financial privacy, such as donors giving money towards political causes or keeping information about their wealth private. However, it has also gained appeal among cybercriminals seeking ways of laundering illicit funds.

This was evidenced in the Treasury Department’s announcement regarding sanctions against Tornado Cash due to its role in facilitating over $455 million worth of cryptocurrency is being laundered by North Korea-affiliated hacking organization Lazarus Group from Axie Infinity’s Ronin Bridge protocol, as well as stolen funds received via Harmony Bridge and Nomad bridge earlier in 2022.

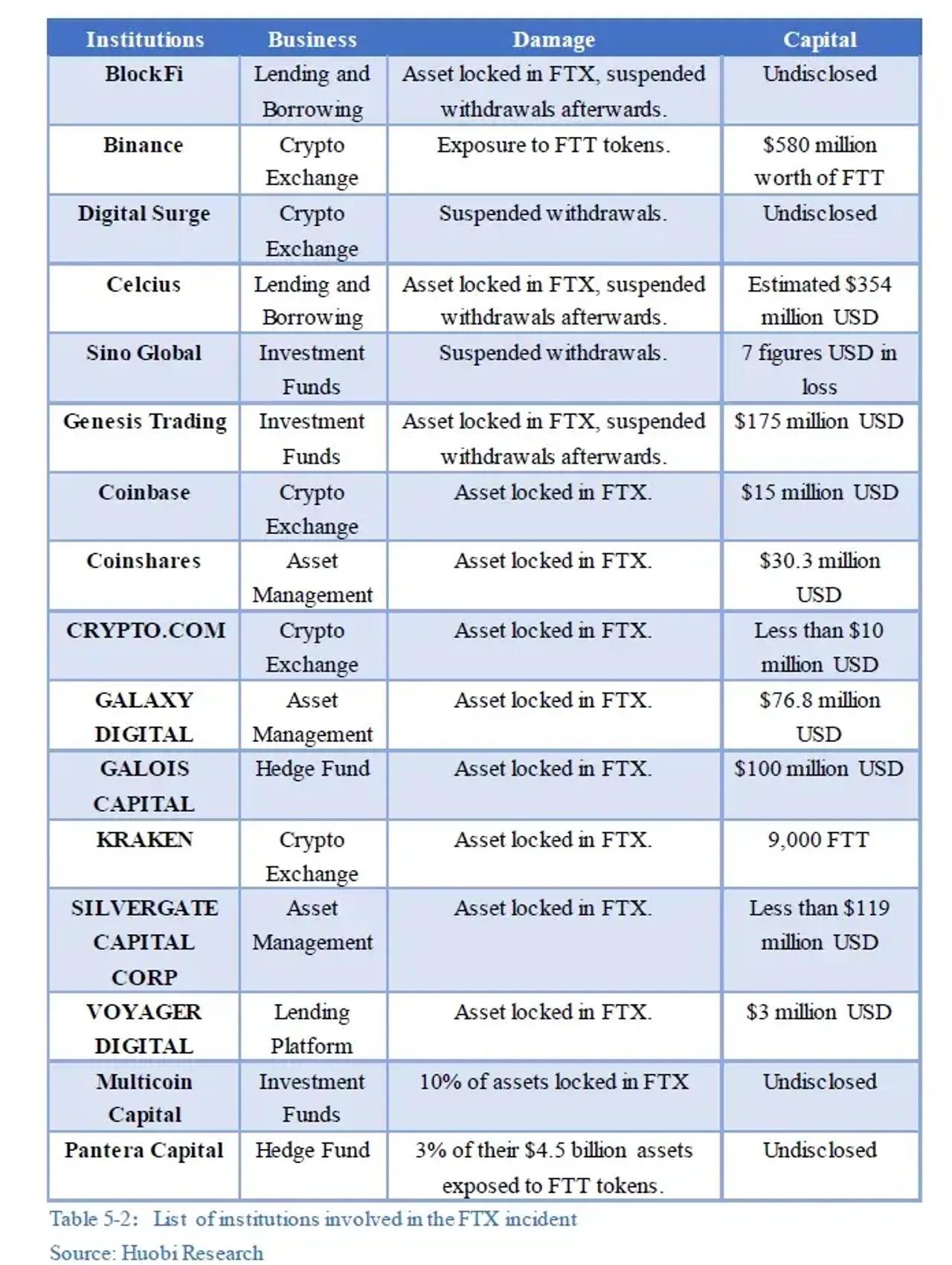

Under the visionary leadership of 28-year-old Bankman-Fried, FTX achieved incredible success in just three years. With an innovative approach to marketing, from a Super Bowl ad campaign, the purchase of naming rights for the Miami Heat’s home stadium, political lobbying efforts, and industry investments, their estimated value skyrocketed to $32 billion. When cryptocurrency values dropped sharply in early 2022, his sound business acumen enabled efficient deals totaling around $ 1 billion, aiding struggling companies held back by token price declines.

In November 2022, a 10-day period of tumult began when CoinDesk uncovered that Alameda Research – the quant trading firm overseen by Bankman-Fried – held an immense $5 billion stake in FTT, FTX’s native token. Of particular concern was its undisclosed leverage and solvency, as it had based its investment framework on this specific crypto asset over other traditional or digital currencies. This news sparked disquiet throughout the whole cryptocurrency field.

On Nov 8th, the world’s largest cryptocurrency exchange, Binance announced that it had reached a non-binding agreement to purchase FTX’s non-U.S business branch at an undisclosed cost. However, after corporate due diligence raised concerns about customer fund mishandling and other issues on Nov 9th., Binance pulled away from the deal resulting in no bailout being granted by one of its close rivals.

The sudden collapse of FTX highlights the fragility of cryptocurrency markets and could further dissuade potential investors concerned about security.

Unfortunately, customers may not be able to recoup their assets due to this incident, potentially leading them down an arduous legal path. The severe repercussions from the failure of FTX have also prompted regulatory authorities such as the U.S. SEC to consider tighter scrutiny on cryptocurrencies going forward.

Despite the tumultuous crypto markets and platforms crumbling, many remain hopeful that their digital currency will one day reach its stratospheric potential. With unwavering optimism in the face of a financial rollercoaster ride, this passion for cryptocurrency has no bounds!

The potential of cryptocurrency as a long-term investment is still largely unknown, yet it continues to capture the attention and speculation of investors worldwide. Experts may make their best guesses about what will happen in its future value, but no one can say for certain. It’s important to approach such investments with caution.