Share on

- Copy link

USDC, a key player in the stablecoin ecosystem, enables investors to acquire crypto assets. A recent development in the stablecoin ecosystem shows that USDC can again start its quest to overthrow Tether.

Last updated Sep 30, 2022 at 07:50 PM

Posted Sep 30, 2022 at 08:00 PM

We will explore the recent developments in the USDC ecosystem. Later, we will also discuss why USDC can start its quest to overthrow the largest stablecoin in the ecosystem. Let’s begin!!

What’s the Recent Market Situation?

Currently, Circle offers native support for USDC on eight blockchain platforms: Ethereum, Solana, Avalanche, TRON, Algorand, Hedera, Flow, and Stellar. Every digital dollar of USDC that is available online is fully backed by cash and short-term U.S. Treasury securities, making it convertible into actual U.S. dollars 1:1.

There is currently nearly $49 billion worth of USDC in circulation, according to Circle's official website. There are 1.5 million USDC holders, according to data from Etherscan, with Maker having the most with 3.3 billion USDC. With a presence in more than 190 nations as of September 23, USDC had on-chain transactions worth $6.23 trillion.

CoinMarketCap estimates that the market cap of USDC is currently $48.8 billion. Over the last day, USDC was exchanged for $4.4 billion.

CoinMarketCap

Circle, the firm behind the stablecoin, said that it was expanding its network with several chains. In an official statement that was made public during the Converge 2022 conference, the financial technology company said that it was integrating 5 blockchains into the USDC system.

It's interesting to note that the techniques used in these new chains included both L1 and L2 protocols. Near Protocol (NEAR), Cosmos (ATOM), Optimism (OP), Polkadot (DOT), and Arbitirum were among the multiple-chain expansion's participants. The crypto community will be wondering if this growth is necessary to help the stablecoin overcome its current problems.

Investors in USDC are relieved by this news after seeing the stablecoin banished from Binance, the biggest cryptocurrency exchange in the world. Just a few days later, the WazirX in India took the same position.

The delisting of USDC, USDP, and TUSD as a part of the BUSD auto-conversion feature was announced by both exchanges. All three stablecoin balances will be converted into Binance-issued BUSD as a result of this action.

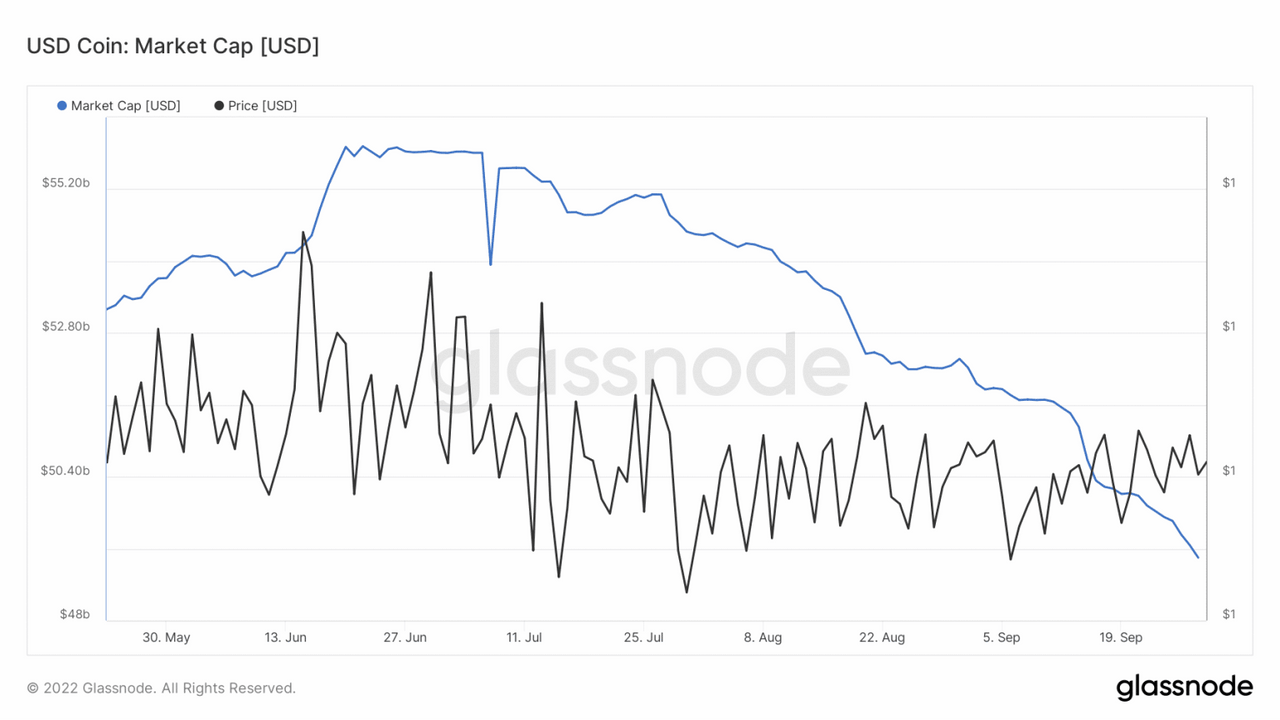

Increased competition for stablecoin issuers and DeFi firms that have started issuing their native stablecoins mean that USDC's multi-chain growth arrives at a crucial time. Due to these events, USDC circulation has decreased by more than 10% since last month, from $55 billion to $49 billion. Let’s explore whether USDC can resume its quest to overthrow the USDT.

After the upgrade, there was no definite indication that USDC would resume its efforts to unseat Tether (USDT). With a $19 million differential in market worth, USDC was still well behind USDT. According to Glassnode data at the time of publication, USDC's market cap was $48.04 billion and continuing to decline.

Galassnode

Further examination of the USDC price revealed that it was remaining constant at $0.9999. Trading at its current price might indicate that it has overcome its earlier problems. It is premature to conclude that the integrations had no impact.

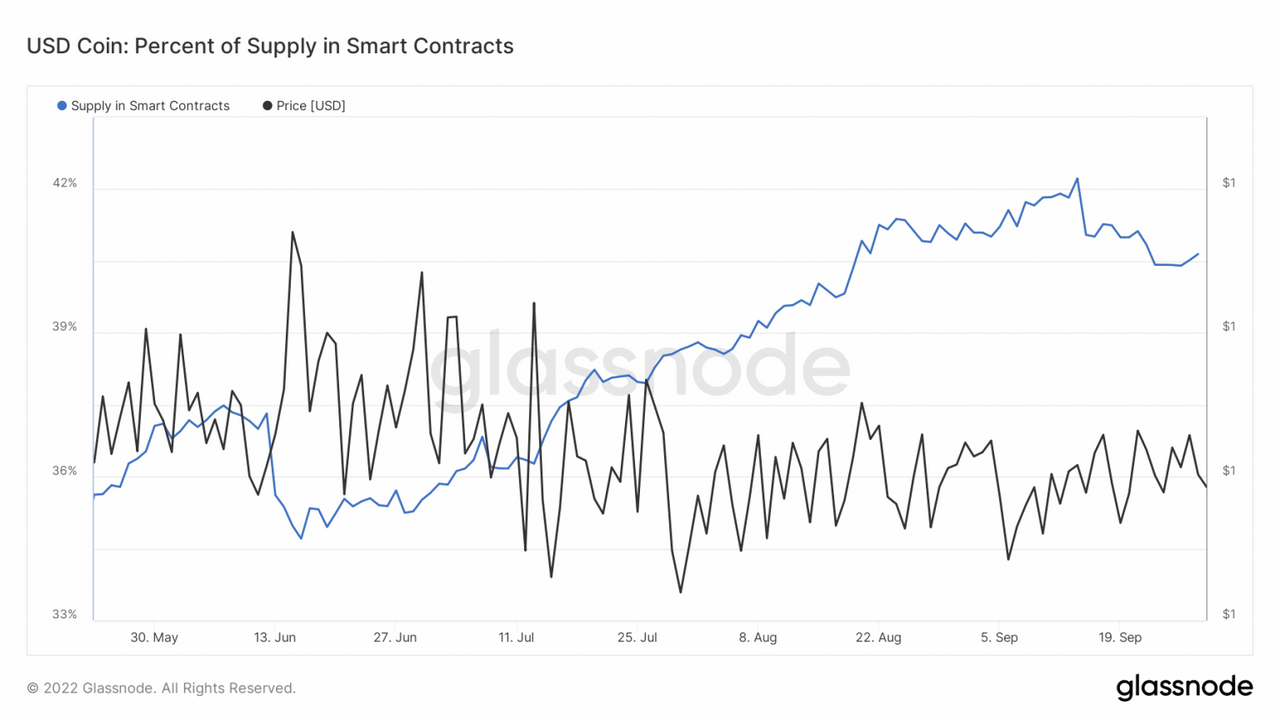

Each network will have a specific duty to perform for USDC. One would benefit from cheaper and quicker transactions thanks to Arbitrum, while improved security would come through Cosmos. The performance of USDC in that area did not appear to have decreased noticeably with some of the chains participating in the deployment of smart contracts.

In actuality, USDC somewhat increased over the previous 24 hours. The USDC smart contract supply percentage grew from 40.41% to 40.64% according to Glassnode data.

Furthermore, it would appear to be detrimental to disregard USDC in the stablecoin war. This is due to a considerable improvement in the 24-hour active addresses on the USDC ecosystem following a dip on September 27. Additionally, active addresses increased from 13,900 on the above-mentioned date to 16,100 as of the time of publication.

On the market, however, there were fewer holdings of USDC since it appears that investors have chosen to hold the alternatives. At the time of publication, there were 7.82 million USDC inflows and 25.24 million USDC outflows.

It seems that these developments will take some time to make an impact on the Stablecoin ecosystem. Once the impact kicks in, USDC can start its quests, but it will take time.