Share on

- Copy link

Volt Inu Price prediction for 2025 is bullish due to the Volt Inu Coin V2 deflationary nature and additional revenue generation techniques.

Last updated Sep 13, 2023 at 05:34 AM

Posted Sep 11, 2023 at 07:00 PM

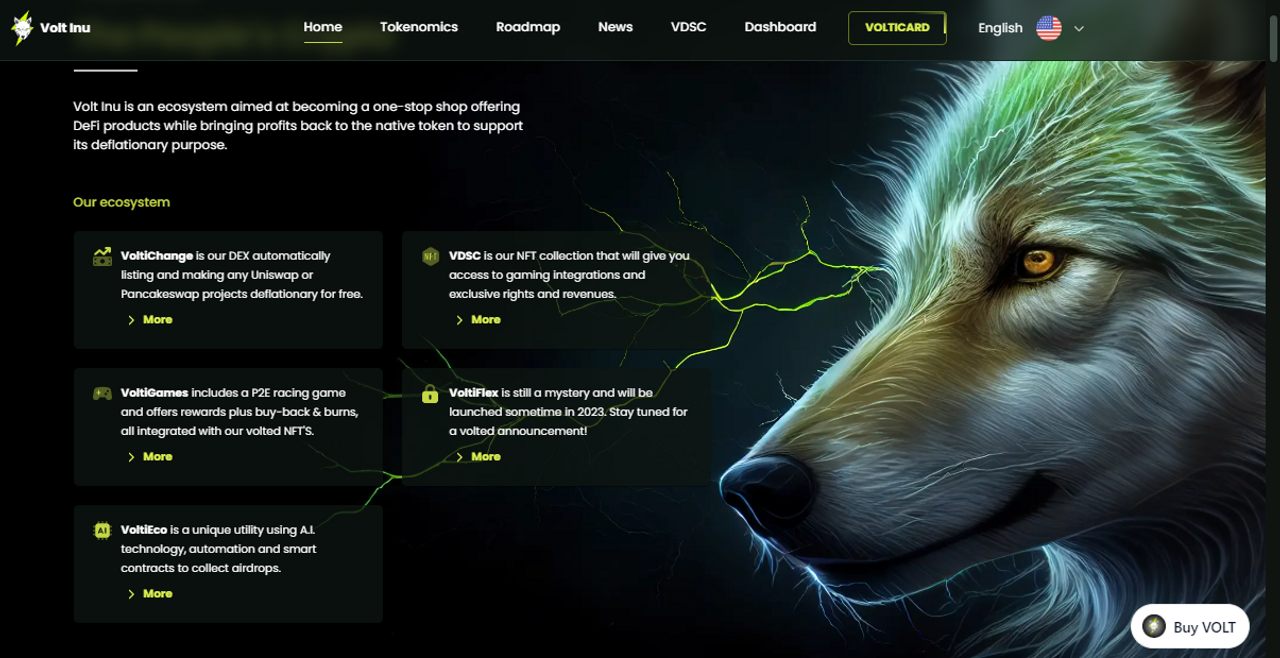

There are thousands of coins and tokens waiting for investors and buyers to get in. Most of the coins are just ponzi schemes while there are some projects that offer real use cases. Dogecoin emerged as one of the most successful meme coins followed by dozens of similar projects. Shiba Inu coin was one such coin inspired by Dogecoin's success. Volt Inu coin names seem to inspiration by the Shiba Inu but offer more utilities and use cases by creating a productive ecosystem.

Volt Inu $VOLT is a coin on the Ethereum blockchain with a whopping supply of 69 trillion tokens, with 55% supply already in circulation. It is common for newer projects like Volt Inu Coin v2, to have supply in billions or even trillions but Volt Inu uses it for its advantage. But we’ll get to that later.

Volt.Inu price might seem lower at this point but this is purely because of its infancy and huge supply. The coin is created to incentivize the holders in many ways. The holders can benefit from the Blue Chip NFT projects and NFT fractionalization through which the profit is shared among the top holders.

These holders acquire nodes on the network and that becomes a source of passive income for these investors. And, obviously, like every other coin, Volt Inu attracts buyers and investors with classic and traditional utilities like stable coin staking, altcoins yield farming, and other revenue generation options.

Volt Inu's current live price is $2.20e-7, and its 24-hour trading volume is $429,528. With a $12,034,291 market cap, the current CoinMarketCap ranking is 686. There are 54,7 trillion VOLT coins in circulation, with a maximum supply of 69 trillion VOLT coins.

Volt Inu coin can now be traded on the main cryptocurrency exchanges Bitrue, Bitget, Hotcoin Global, Huobi, and Phemex.

Volt coin price prediction for 2025 and beyond depends on various factors. This could be the overall market direction, utility creation by the Volta coin team, and ecosystem development in the coming years. This will decide the demand and supply of the Volt Inu Token. If the utilities created by volt.inu attract just 20% of users every year, that can really impact the price of the token.

On November 14, 2022, Volt Inu touched an all-time high and Since then it has dropped by more than 88%. Even though the overall supply of The coin has been reducing, which is enough to impact the volt coin price very effectively.

Volt coin price at the moment is at its lowest but making a good base at the bottom. If an alt season starts at this point, the volt token can gain almost up to 78%, the price level of mid-May 2023.

The $VOLT price remained at 0.0000002400 for over a month, which is currently the bottom. Volt has never had a longer plateau.

The problem with the large circulation coins is that you need a lot of market cap to make the smallest difference. The good thing is that Volt coin is standing firm at the current support level. However, it may fall to the nearest support which is another 50% down from the current price level.

Let’s first try to understand how the circulating supply can impact the price of a coin. Aside from the daily trading volume and demand and supply mechanism, the price of a coin and the circulating supply are inversely proportional.

Initial Price per Coin = Market Cap / Circulating Supply Initial Price per Coin =$11.97 million / 55.77 trillion ≈ $0.000000215

Now let’s take into account the increase in demand and deflation that Volt Inu promises: With 20% increased demand, the new market cap could be:

New Market Cap = Initial Market Cap * (1 + Demand Growth) = $11.97 million * (1 + 0.20) ≈ $14.36 million New Price per Coin = New Market Cap / Circulating Supply =$14.36 million / 55.77 trillion ≈ $0.000000257 per coin

After 2 years (2023 to 2025), the supply reduces to:

New Supply = 30 trillion * (1 - Deflation Rate)^2 New Supply = 30 trillion * (1 - 0.03)^2 ≈ 27.54 trillion coins Final Price per Coin = New Market Cap / New Supply Final Price per Coin =$14.36 million / 27.54 trillion ≈ $0.000000521 per coin

So, with a 20% increased demand, a reduced supply of 30 trillion coins by 2025, and a 3% deflation rate per year, the final estimated price per coin in 2025 would be approximately $0.000000521 per coin. This is a gain of 102% in just 2 years, till 2025.

Volt Inu is an infant project that requires a lot of attention, marketing, and a large community to push the price. Since the coin incentivizes the investors and holders with lots of passive income options. Since we are already in a bearish market, it would be unwise to blame the token team for the price drop. However, if the altcoin market recovers in the coming months, will the price of Volt Inu Coin recover as well? That’s an important question and we can only time it.

Newer crypto projects, though seem promising, can be extremely volatile due to low marketcap. Invest wisely and do your own research.