Share on

- Copy link

Recently the RBI (Reserve Bank of India) told the government of India to ban cryptocurrency as it is a financial threat to their economy. Can this possible Indian ban on crypto create FUD (Fear Uncertainty Doubt) and crash the market?

Last updated Aug 3, 2022 at 02:25 PM

Posted Aug 3, 2022 at 01:00 PM

India and Crypto:

According to a report that included over 2500 people that use the Internet daily, more than 29% hold cryptocurrency – double the global crypto adoption of 14.6%. India is a big country with a huge population and claims over 100 million crypto users. According to another report, 7.4% of Indians already use cryptocurrency. However, the local famous cryptocurrency exchange WazirX claims that the 100 million number is not true: there are 10 to 15 million crypto holders or traders according to the exchange data.

Nonetheless, India constitutes the largest crypto community in the overall market. India has already imposed a 30% tax on cryptocurrency trades without any exemptions or deductions. Also, over 1% will be applicable as TDS and all the tax will be deducted at the time of the credit of the amount.

India Ban on Crypto:

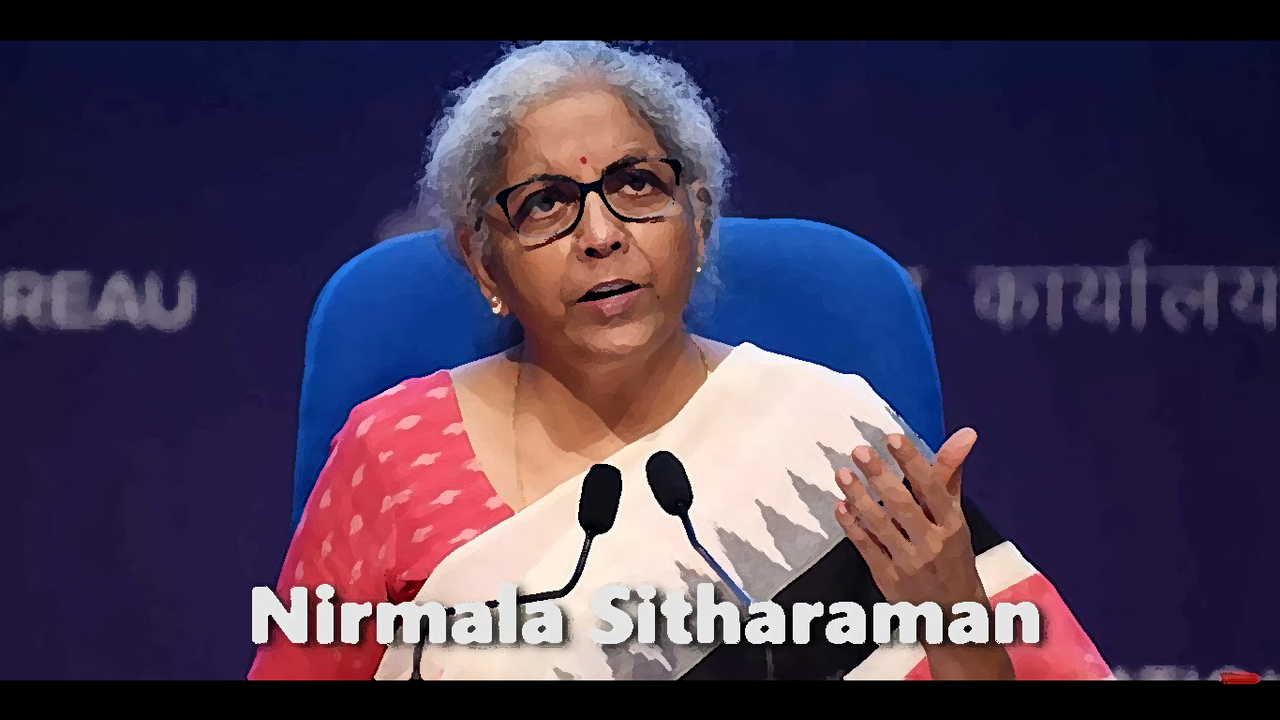

The RBI wants a complete ban on all digital assets including cryptocurrency and seeks international collaboration if such a ban is put in effect. The bank stated in its annual report that only banks and governments are allowed to release tokens or currencies and no third party can be allowed to do so. The finance minister of India Nirmala Sitharaman told the parliament that cryptocurrencies and other digital assets are concerning for the economy of the country. Therefore, banning these assets must be a priority for the Indian government.

Finance Minister of India

Cryptocurrencies are borderless, trustless, and pair-to-pair assets that do not require a third party to send and receive the payments. Cryptocurrencies are decentralized in nature – means there is no single entity that can control them. Even in centralized crypto exchanges, it is hard to control assets and transactions. It becomes a really big problem if the users are using the Decentralized Exchanges DEXs. These DEXs don’t require a KYC to use these platforms, and there is no way to track the location of the users.

Acknowledging those realities, the finance minister of India told parliament that “Cryptocurrencies are by definition borderless and require international collaboration to prevent regulatory arbitrage. Therefore, any legislation for regulation or banning can be effective only after significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards.”

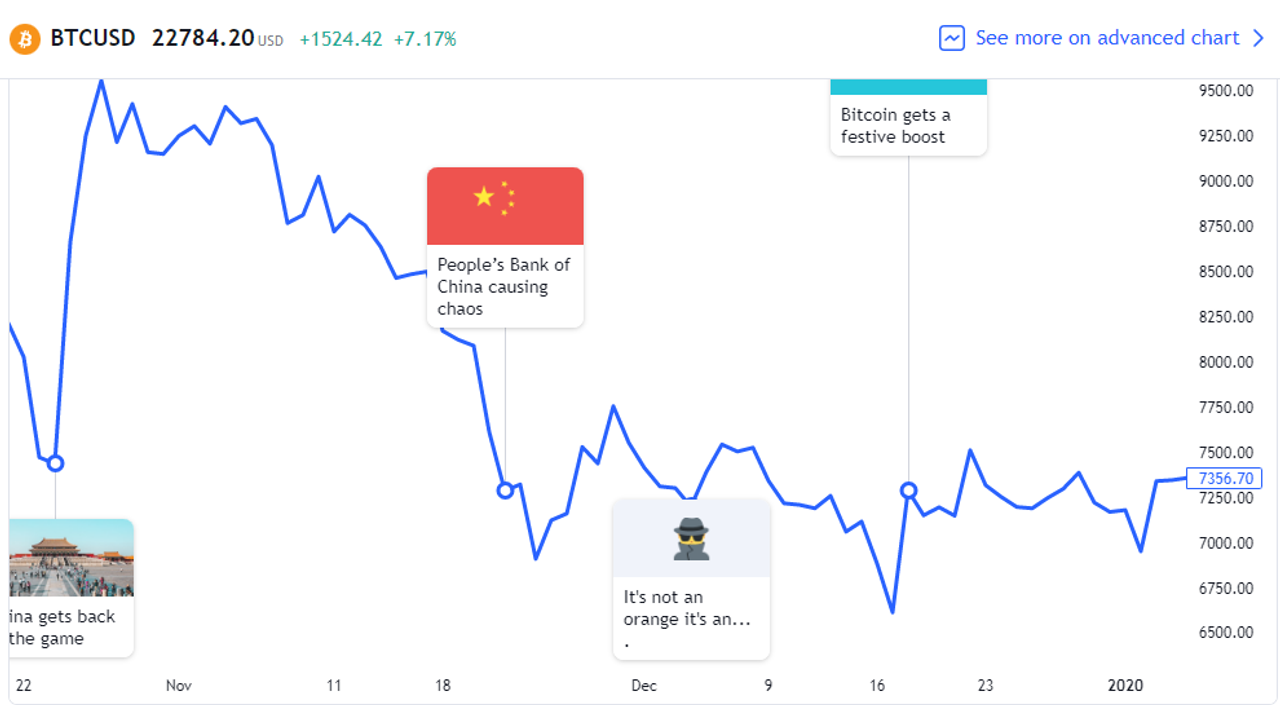

Cryptocurrency is very fragile and highly responsive to news. If there’s good news about it, Bitcoin pumps to the moon, and if there’s bad news the prices drop. When Tesla announced it would be accepting Bitcoin, Bitcoin rose from below $40,000 to $64,000; when news broke that Tesla was reversing its decision, the prices fell even further than previously.

China has a history of banning Bitcoin and cryptocurrency. On November 22, 2019, the FUD sent Bitcoin to a newer low. China had been doing this every now and then; it finally banned all cryptocurrency transactions and mining activities.

India has already aroused FUD (Fear Uncertainty Doubt) by imposing a huge tax on cryptocurrency trades. The tax was imposed in February 2022 but fortunately there was little response to it and Bitcoin did not show many drops.

If India indeed bans crypto, this move will send a shock wave through the entire cryptocurrency market, which will lose a huge crypto community. However, the magnitude and the time of the fear are still uncertain. If Bitcoin survived after losing China’s crypto-loving people, it can also stand losing another country like India.

The magnitude of the bearish trend due to this ban will not be much larger or longer. That’s the good thing about Bitcoin – it survives everything, every time.